Occasionally there are times when we are required to –like it or not — act like a technical analyst. This is one of those times, so we warn our readers so they can be prepared to take the letter with a large grain of salt.

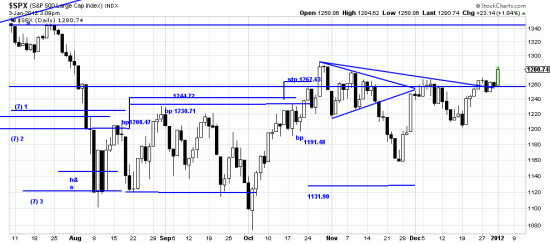

Since the head and shoulders top curse was fulfilled the market has essentially ground sideways — August to present. It has been clear to us that this period of bungee jumping, flash trading and false signals was accumulating a large store of energy that would have to be dissipated someway. The casually uninformed and network technical analysts talk about a base being built — and not to be more disrespectful than necessary, you could probably talk about it that way. Wyckoff talks about cause and effect — a large sideways pattern basically predicting that — when released — the energy stored there would have a larger than ordinary result. There is something to this. Readers will remember that chart formations are often thought to have measuring implications. Readers will also remember that we are, in general, always skeptical of the whole measuring thing. The reason for this disease with measuring is that we don’t like setting up expectations and targets. We prefer to observe the moment and act according to its imperatives. Sometimes these coincide with the measurements, sometimes not.

Since the head and shoulders top curse was fulfilled the market has essentially ground sideways — August to present. It has been clear to us that this period of bungee jumping, flash trading and false signals was accumulating a large store of energy that would have to be dissipated someway. The casually uninformed and network technical analysts talk about a base being built — and not to be more disrespectful than necessary, you could probably talk about it that way. Wyckoff talks about cause and effect — a large sideways pattern basically predicting that — when released — the energy stored there would have a larger than ordinary result. There is something to this. Readers will remember that chart formations are often thought to have measuring implications. Readers will also remember that we are, in general, always skeptical of the whole measuring thing. The reason for this disease with measuring is that we don’t like setting up expectations and targets. We prefer to observe the moment and act according to its imperatives. Sometimes these coincide with the measurements, sometimes not.

We may make these measurements from a chart formation –or, we may use a Wyckoff method, using Point and Figure charts. PnF charts are a fascinating chart method. They ignore time and volume and operate on pattern alone. We demonstrate:

This chart is from stockcharts.com where the reader can experiment with and learn about the method. As you will see from the header information there is a bullish price objective of 1460 for this chart. This is a price target derived from conventional PnF methodology. On the other hand, if one uses Wyckoff’s method one might derive a price target of 1860 from this chart.

This chart is from stockcharts.com where the reader can experiment with and learn about the method. As you will see from the header information there is a bullish price objective of 1460 for this chart. This is a price target derived from conventional PnF methodology. On the other hand, if one uses Wyckoff’s method one might derive a price target of 1860 from this chart.

Remember we warned you to disregard this letter. More on that later. Here is how the Wyckoff analysis works. We count the sideways (Cuase) period. We take it to be from the column with the 8 in it (meaning August) to the column with the 1 in it (January). This gives us 26 boxes. We multiply by 3 (the reversal size) and multiply by 10 (the box size). This gives us 780 which we add to the bottom of the pattern, 1080, which gives us a price target of 1860. Here is the catch 22. We have no idea of the time necessary to reach this number, or whether there will be radical setbacks before it is achieved. (Almost inevitable.) The fact that conventional analysis gives us a target of 1460 tends to buttress the analysis as does the present chart analysis of the market.

More importantly let us talk of psychology. One of the main problems the average investor has with the market is expectations. The market is going nicely — then it gets bombed. They told him the bull market was on and suddenly it’s down 10% in a week. One of the benefits of chart analysis is that it gives one some idea of what is possible — or even probable. We see a broken trendline we know to get set for some unpleasant activity. We see prices break away to new highs we know that we will probably have some smoother sailing for awhile.

The present forecast tells us to get ready for something new. Naturally we don’t bet the ranch. We bet the outbuildings and the outhouse. (Scaling in.) Additionally, as we have noted, our Basing Point systems are long — and have been. Remember the rule of confirmation of multiple techniques.

Now this may sound like mumbo jumbo to you so we suggest the following little exercise:

Note the 11 at the lower axis. In that column there is a C a 1 and a 2. Count crossways to the column with an 8 in it. Take that number of boxes (columns), multiply by 3, and the result by 10. Subtract the result from the number in the 5 column and see what number you get. (Since we have downwave forecast.) See if the forecast from this method is bourne out in the chart.

Now to repeat. We detest price targets for trading and investing. As Ram Dass said, Be there then. On the other hand maybe 1460 is not so far fetched. Remember also. The market manages the expectations of investors. It does everything it can to shake out the unwashed and unworthy, then it sneaks to easy money highs rewarding the (other) unworthy, the wicked and the reprehensible and causing the virtuous and worthy to froth at the mouth and buy the market top.