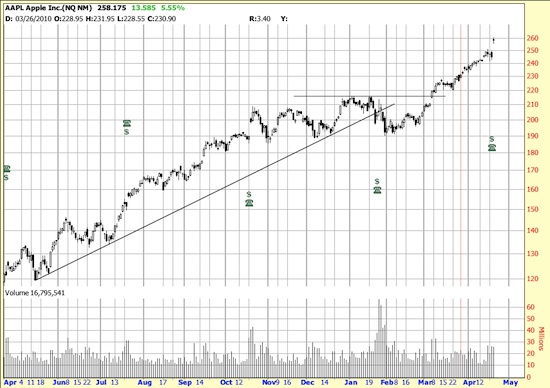

Well, Apple is still throwing off buy signals. When we read in Marketwatch that analysts are predicting $1000 share price our first impulse is to sell short. But Apple is truly a phenomenon. And strange that we have never owned it. We love the company, love the computers, love the iphone — and we have dozens of studies of the stock.

Well, Apple is still throwing off buy signals. When we read in Marketwatch that analysts are predicting $1000 share price our first impulse is to sell short. But Apple is truly a phenomenon. And strange that we have never owned it. We love the company, love the computers, love the iphone — and we have dozens of studies of the stock.

Apple is a reasonably high risk stock now — because of the long trend — but then so was Microsoft on its giant run. The way you handle this is to divide your capital commitment into 3 to 5 tranches, buy 1 now ( with a stop 5% down) and commit the other units depending on continued good behavior. Another way to do it is to sell naked out of the money puts. If you get exercised you wanted to own it anyway and so now you do. And the way the trend is going you might get free money.

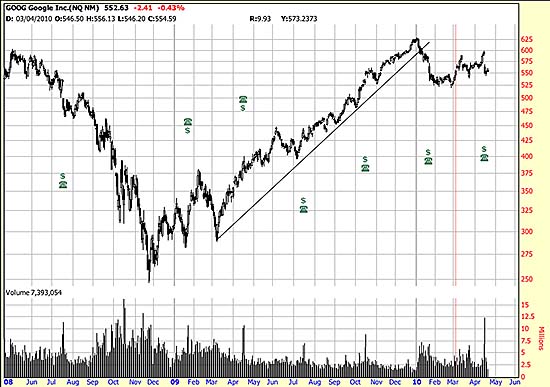

Google, on the other hand we would not buy right now — but we might do the naked put thing and also the multi-tranch thing although GOOG is a dicier deal. It’s clear isn’t it, why we wouldn’t go out and buy it like Apple? Look at the broken trend line. And after the break it is basically sideways in a trading range.

Google, on the other hand we would not buy right now — but we might do the naked put thing and also the multi-tranch thing although GOOG is a dicier deal. It’s clear isn’t it, why we wouldn’t go out and buy it like Apple? Look at the broken trend line. And after the break it is basically sideways in a trading range.