Predicting is always difficult, and above all when it concerns the future. As Nils Bohr was fond of saying.

Predicting is always difficult, and above all when it concerns the future. As Nils Bohr was fond of saying.

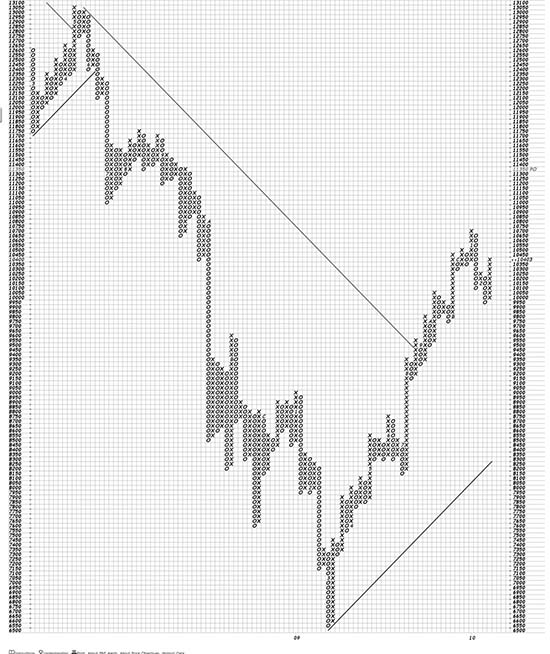

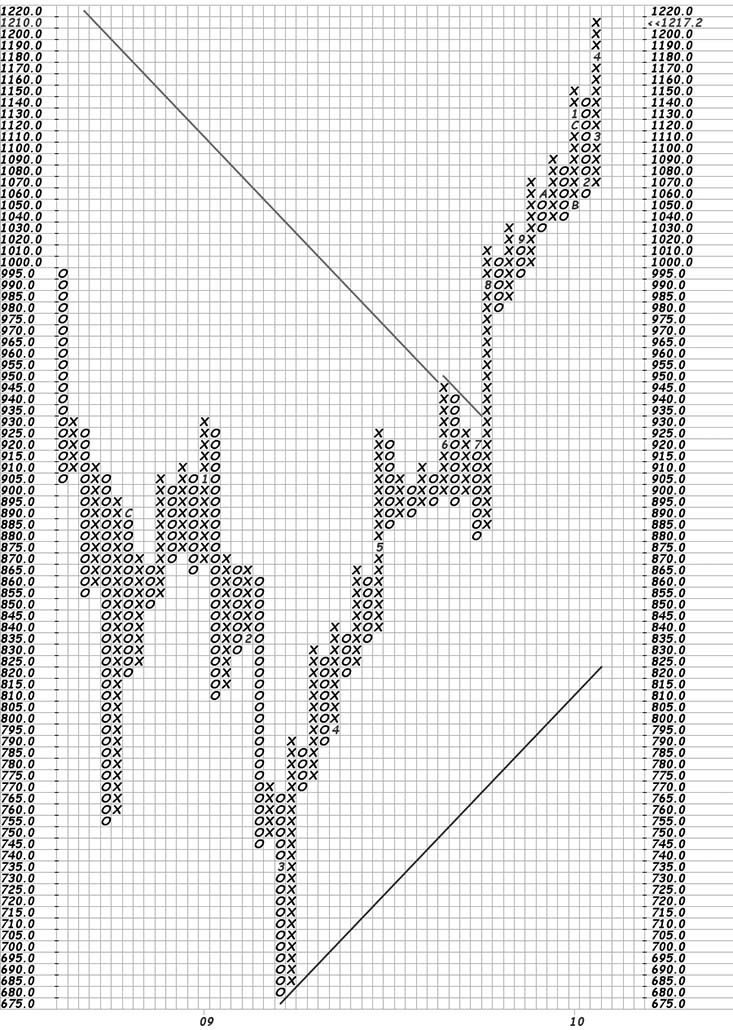

First of all let us make clear that we do not stand behind our predictions. Or, as John Kenneth Galbraith said, the purpose of economic forecasting is to make astrology look good. The interpretation of the chart above is less a question of analysis than it is a species of long term economic forecasting. It is what is called a point and figure chart.

But what some technicians do with this chart is project a price goal into the future. In fact this discipline, which is more a practice of Wyckoff analysis than of Edwards & Magee is interesting, and has some validity. What is done is to count the boxes (each X or O is a box) across the pattern, multiply the number of boxes by three, multiply by the box size, find an anchor point and add the sum to the anchor point, giving a price goal.

Using this arcane procedure we compute what a feasible price objective would be. We can obtain various price objectives depending upon what part of the pattern we measure across and where we put our anchor point.

The theory behind this is that the market builds a base and coils up energy, and when it blows out of this base its trajectory will be determined by the base built. Very common concepts.

A believable objective for the Industrials using these tools is 13750.

For the S&P 500 the objectives range from1296 to 1800.

Now here is the thing about PnF charts. There is no time frame. It is entirely possible that we are on the verge of a great wave upwards. But the chart makes no time prediction, nor does it predict the wave forms we will see in the upwave.

Now here is the thing about PnF charts. There is no time frame. It is entirely possible that we are on the verge of a great wave upwards. But the chart makes no time prediction, nor does it predict the wave forms we will see in the upwave.

But we, being Magee analysts, know that there will be downwaves in this process and that we must be prepared to sit through them — or attempt to manage them in some way.

In fact we should be prepared for a downwave at any time, because an extended upwave is highly unlikely without an attempt by market forces to shake out all the unworthy before rewards are handed out.

Remember. Prediction is difficult. And prediction is of a lower priority than looking at the market directly in real time.