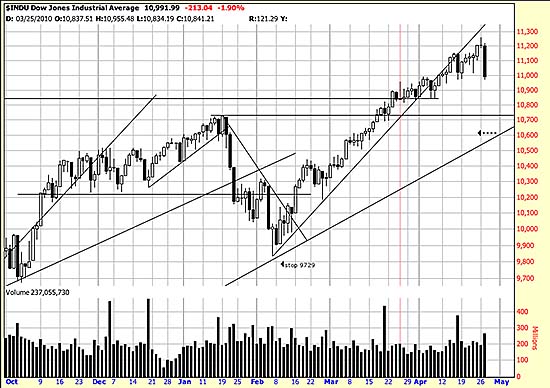

In view of the barbarians pouring over the walls we thought we would update stops for the Dow. These points may be used as benchmarks for the S&P and the ETFs. Not much of an update. The stop of 9729 we set back in December is still the Wave low stop. It held the Dow then, and it would be extremely surprising if it didn’t hold the Dow now.

In view of the barbarians pouring over the walls we thought we would update stops for the Dow. These points may be used as benchmarks for the S&P and the ETFs. Not much of an update. The stop of 9729 we set back in December is still the Wave low stop. It held the Dow then, and it would be extremely surprising if it didn’t hold the Dow now.

Undoubtedly that is a long way down. There is another way to set the stop, and we have marked the approximate spot with asterisks, because we think it is too close to the market. That is, we take the low of the high day and use it as a Basing Point with a filter of 5%, which is the Variant 2 of the Basing Points Procedure. This stop is 10628.26. The problem with it is a downwave of 8-9% could easily be in store here which would chase our positions from the market. Of course we can always reenter but long experience has shown that bearing these downwaves with a smile (a grimace?) is best over the long run. We have been warning of the downwave for sometime, so it should be no surprise to our readers.

Today’s extreme action is not really due to Greece, or Goldman being grilled in Congress (justifiably) or the phase of the moon. Volatility had sunk to a low and was due to revert to the mean, and after more than 53 days up the market was overbought. Bears and contrarians were pinched in their short positions, so when the market started down they jumped on it, along with nervous newcomers.

We suspect that investors who missed the train will leap on this downwave as soon as they think it safe, because everyone realizes we are in a serious uptrend and those who missed the train have been gnashing their teeth in frustration.