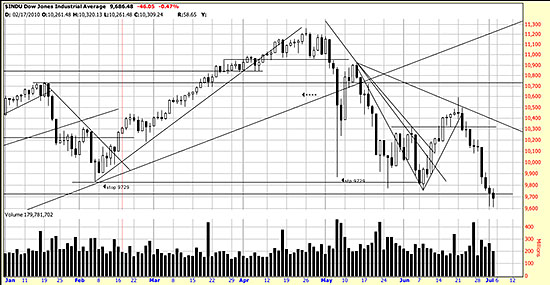

The most destructive habit — or decision, or characteristic or event or test of character– in the markets is to contemplate a stop long set, and to reconsider it. Actually it’s ok to reconsider it, but it’s not ok to decline it. Only if it were set in error should it be negated. Error means a glaring error in procedure, or in computation. The present stop is a valid stop. Those who ignore it will end up like the owners of Enron. The stop at 9729 is violated.

The most destructive habit — or decision, or characteristic or event or test of character– in the markets is to contemplate a stop long set, and to reconsider it. Actually it’s ok to reconsider it, but it’s not ok to decline it. Only if it were set in error should it be negated. Error means a glaring error in procedure, or in computation. The present stop is a valid stop. Those who ignore it will end up like the owners of Enron. The stop at 9729 is violated.

This stop should have been honored on the close Friday. There is a lot of weekend here for the Greeks, or the Germans, or the Chinese, or the Japanese, or the Iranians, or the Iraqis or…. As some Secretary of State said the sun shines 24 hours a day around the world and somewhere someone is making mischief.

Naturally an upwave is overdue, meaning that the market will mock those who do the prudent thing here. That’s all right. If it is a valid upwave we will rejoin the bull side.

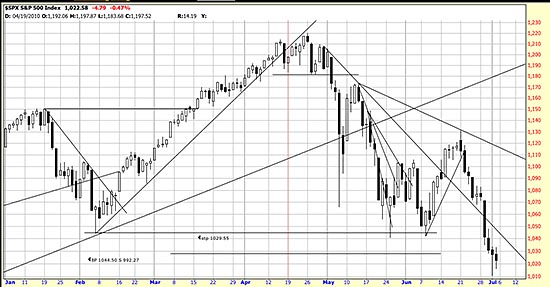

The stop is violated in the S&P also. There is nowhere to hide.

The stop is violated in the S&P also. There is nowhere to hide.