Tuesday didn’t furnish much of a bounce, but as this is written Wednesday one could think — well, maybe this is over. And maybe this downwave is over, but what is not over is the general state of the market. Which is in a trading mode. And the trading mode is within a downtrend. During times like these investing and trend following can be very frustrating.

Tuesday didn’t furnish much of a bounce, but as this is written Wednesday one could think — well, maybe this is over. And maybe this downwave is over, but what is not over is the general state of the market. Which is in a trading mode. And the trading mode is within a downtrend. During times like these investing and trend following can be very frustrating.

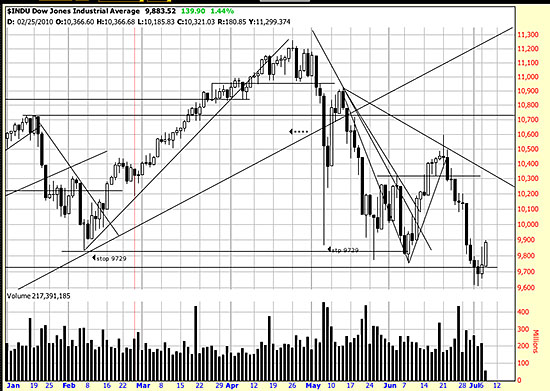

Probably for the majority of investors just being flat, or hedged is the wiseest course right now. As can plainly be seen from the chart you can be short for a few days, then long, then short and only the most skilled of traders can follow twists and turns of this nature.

We really can’t see the long bounce right now as anything more than that — a bounce. We would have to see the June high taken out before we would consider the downwave to be arrested. In the meantime we might see a few days of upwave here.

We have remarked on our discomfort with our stop of 9729. Whether the market was just reaching for stops (and found ours) or whether a true downtdrend is in progress is yet to be determined. If our lower stop of 9408 were taken out we would get short, but as is we will either trade or hedge.

It goes without saying that readers must examine stocks of individual issues they own before selling them. If the chart has not turned south it should be held — for example in some dividend stocks we looked at there were no signs of downtrends.