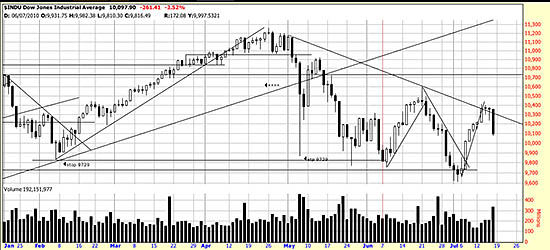

Yesterday we pointed out that the upwave had ended and today the market wreaked vengeance on any traders who ignored that trendline. It is entirely possible that we will see a violent downwave here, and if you are trading you should have used yesterday’s power bar to get short, and the hourly chart to protect yourself. As they say, never a dull moment. The market mischief makers move the market so fast on the opening that you’ve been had before your get your eyes open or your first cup of coffee. They make up for it blowing it away on the close. What we ought to have is a 24 hour market so they couldn’t mess with it like this. In case you haven’t heard they are planning that. They are going to implement it right after they install the Congress that hasn’t been bought and paid for.

Yesterday we pointed out that the upwave had ended and today the market wreaked vengeance on any traders who ignored that trendline. It is entirely possible that we will see a violent downwave here, and if you are trading you should have used yesterday’s power bar to get short, and the hourly chart to protect yourself. As they say, never a dull moment. The market mischief makers move the market so fast on the opening that you’ve been had before your get your eyes open or your first cup of coffee. They make up for it blowing it away on the close. What we ought to have is a 24 hour market so they couldn’t mess with it like this. In case you haven’t heard they are planning that. They are going to implement it right after they install the Congress that hasn’t been bought and paid for.

The power bar down yesterday makes us think that a downwave is starting here, but that is just educated analysis and we will know more Monday. We will know when this market changes character from the wave length.

Meantime… gold! gold! gold in….

The Basing Point and stop is illustrated in the gold. No less a figure than Robert Prechter thinks gold is going down the tubes. We are thinking about what he thinks. In the meantime you can think about this stop which is generous. Gold has constantly shown that it can reach for the most generous stops. For the moment it seems to be semi somnolent — but you know what they say about sleeping gold bugs — never kick one.

The Basing Point and stop is illustrated in the gold. No less a figure than Robert Prechter thinks gold is going down the tubes. We are thinking about what he thinks. In the meantime you can think about this stop which is generous. Gold has constantly shown that it can reach for the most generous stops. For the moment it seems to be semi somnolent — but you know what they say about sleeping gold bugs — never kick one.

Bonds! bonds! bonds in….

If you are long bonds (and perhaps should be) (though maybe not at this late date) you should note the Basing Point and stop indicated here. That is the systems stop. We might even stop it up tighter under that horizontal line there, since the trendline is broken. If we saw a double top here we would be inclined to short the bonds. Sooner or later the market has got to come home to roost on those bonds, and when it does there will be guano all over the place.

If you are long bonds (and perhaps should be) (though maybe not at this late date) you should note the Basing Point and stop indicated here. That is the systems stop. We might even stop it up tighter under that horizontal line there, since the trendline is broken. If we saw a double top here we would be inclined to short the bonds. Sooner or later the market has got to come home to roost on those bonds, and when it does there will be guano all over the place.