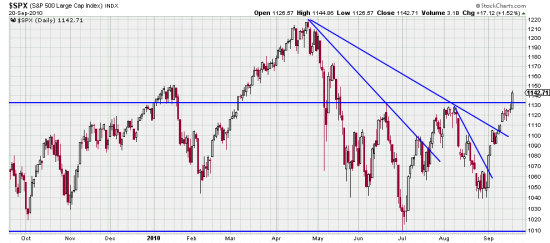

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p62881197949&a=207879904

We are not much contrarians — because we assiduously avoid joining fads and cults and cliques. And we avoid attaching too much importance to any idea or concept. We prefer to look directly at the facts. If everybody is going to be a contrarian we’re going to be an anti-contrarian. But if you think about it you could make a contrarian analysis of the news, b.s., blather and talking heads over the last few weeks — chicken littles squawking about double dips, economic catastrophe and the end of the world as we know it (teotwawki). It might make an anti-contrarian prick up his ears and start buying. All this while the gold, the silver, the Qs, the major indices were in clear upwaves.

It is often interesting and amusing to us to listen to the news and market noise and then look at the chart and see how damnably misguided they are. It is a consequence of their not knowing how to read a chart.

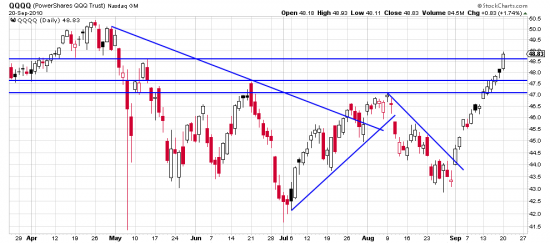

While they have been predicting the end of the world the Qs have been booming and the SPX has made new highs — not the ultimate new high, but strong enough to create a buy signal. The power bar across the horizontal line is certainly that. So it is time to either start getting long, or get longer. This is also true of the Qs. Of course there will be some pullback here and that is always annoying, but that’s the way it is.

We understand that a Dow Theory buy signal has occurred, which concurs with our occurrence, concurrently.

http://stockcharts.com/h-sc/ui?s=QQQQ&p=D&yr=0&mn=6&dy=0&id=p39697041562&a=203282119

These trends are too steep to last — but then the last leg of the Dow bull was 56 days, so he who rides the tiger has to get on and hope he doesn’t get bucked off.

Something of psychology might be said here –Putting on one unit of a multi-unit position makes it easier to add other units as the trend progresses. To examine this concept take a look at the letter we wrote in Sep 09.

http://www.edwards-magee.com/buythedowsep09.pdf

We will be adding to our positions on these clear signals.