http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=1&mn=0&dy=0&id=p62881197949&a=207879904

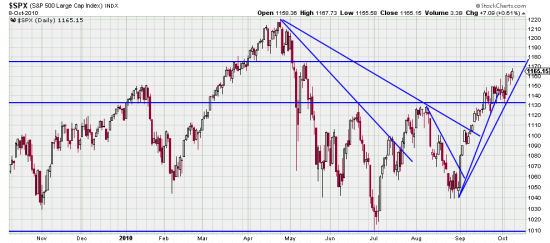

The sideways drift in the SPX in late September — and other indices — resulted in the construction of a more reasonable trendline, the last on the chart. The previous line has been left to illustrate the change. The Dow, though not illustrated here, is actually more significant, as not only did it take out the psychological 11000 level it took out the important May high. When the SPX does the same we will have a bullish confirmation.

The drift reduced the likelihood of an immediate downwave, but it is only a matter of time, and the October demon creeps around on little cat’s (black) paws, as Carl Sandburg would say.

The ghost of October’s past certainly haunts the market and the more extended the present trend the more painful the downwave will be. Though there is support at 1130 we expect this downwave will probably reach 1100 and scare the be-cat out of everybody.

What can you do? You could set your stop 3% under Friday’s low. Of course what close stops always do is make you vulnerable to the the gotcha trick of the market mischief makers. It’s a trading stop. The Basing Point stop is so far away it might as well be in Bejing (with most of our dollars). A tenuous case could be made for a Basing Point at the 9/23 low of 1122.79 (5% down). But don’t just sit there. Set your stops. If you have set your stops when the going is good you won’t have to agonize when the going is bad, which it will be.

http://stockcharts.com/h-sc/ui?s=FXE&p=D&yr=0&mn=6&dy=0&id=p80569589766&a=208514517

The FXE trade is piling up profits. Notice how the horizontal trend lines have been definitive in the analysis. Trade wise, if the gap got closed here we would be running for cover. Other wise a stop 3% down from Thursday’s low would avoid giving back all the profits.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=6&dy=0&id=p23550335056&a=203282120

d be licking your chops and enjoying the profits of the GLD trade. Trade wise, if the gap got closed here we would be running for cover (same with the silver and platinum). Other wise a stop 3% down from Thursday’s low would avoid giving back all the profits.The WSJ noted that there is heavy put buying here. Worth considering. You could also sell a covered call. Please don’t do this if you are not experienced with options, or have an experienced broker.

Enjoy the profits and get ready to give some back. That’s the market.