We often do not comment on the obvious, as GOOG and AAPl are. If you have major capital they should certainly be in your portfolio. We trust our readers to recognize the obvious — in fact you should be emailing us pointing out the obvious.

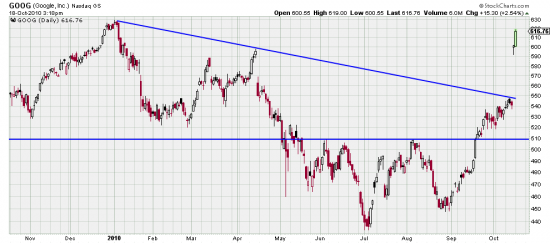

Both issues have popped out of trading ranges and are showing strong buy signals.

In the case of GOOG a handsome gap after exiting the trading range on strong power bars.

In the case of AAPL a classical exit and throwback to the exit line before producing a power bar the last few days. But we wouldn’t be surprised to see the stock hammered for profits after their earnings announcement. Buzzards set to do that.

We especially like AAPL because the press, now fawning over the company savaged it before Steve Jobs started producing whole new industries — at a time when it was producing the best personal computers in the world. But then we love it when the talking heads, pundits and press have to eat crow with egg all over their faces.