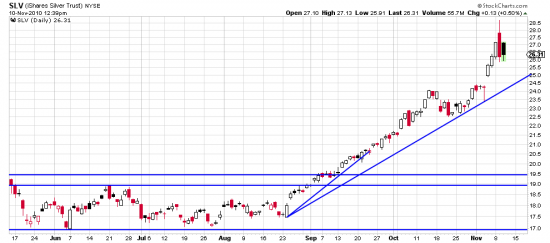

http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=6&dy=0&id=p59476852126&a=203282121

http://stockcharts.com/h-sc/ui?s=TLT&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=203282126

SLV: 3.57%. GLD: 4.10% and TLT: 2.33%.

Ranges for the metals and bonds. When we first saw the markets freaking out we tried to call Batman but his phone was busy. Then we learned that the Merc had increased margins on silver contracts. That always causes perturbations if not major and minor chaos. For traders it looked like a heavy duty reversal day. and depending on where you got in and got out it could have been fatal. We closed our silver and gold trading positions.

But consider this. We left our trend positions on. And so should any trendfollower. As reflected in today’s activity the Merc’s surprise attack did little to dim enthusiasm (how is that spelled? irrational exuberance?). These markets were entering into runaway mode. What will happen now is any treasury secretary’s guess but, as Damon Runyon said, the way to bet is with the trend.

That’s the way to bet in the TLT which experienced an engine flame out on its trajectory lower. (Please excuse the vivid writing. It was an exciting day.)

Stops: We think the lows of SLV: 23.41, GLD: 129.38, high in TLT: 102.27, plus or minus 3% are rational stop levels. Note that we haven’t done the computations. Why do you think that is? Super tenacious and passionate investors might even opt for a higher percentage stop.

Readers who are not long and short these markets should be sued by us for not getting their money’s worth out of this letter.