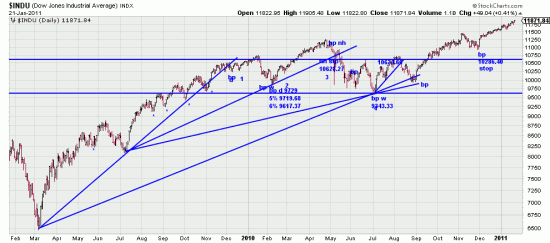

Wednesday the werewolves and were-market makers and Goldman hammered the financials in honor of the full moon. but the trend in the major indices sails serenely on.  This wave is 39 days, and there is still no down wave or retracement on which to base a trendline. Of course you can always go to hourly bars, but all those preachers of gloom and doom who bailed out are now seeing the error of their ways. Try to outsmart the market with a model and you find out how smart your model is. (Usually not very smart.)

This wave is 39 days, and there is still no down wave or retracement on which to base a trendline. Of course you can always go to hourly bars, but all those preachers of gloom and doom who bailed out are now seeing the error of their ways. Try to outsmart the market with a model and you find out how smart your model is. (Usually not very smart.)

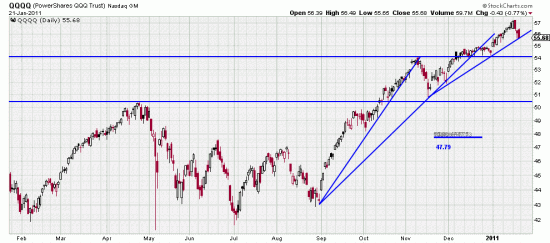

It’s the Qs that are flirting with the trendline. So bear watching if you’re trading. (not recommended) And you can see the stop way down there at 47.79.

It’s the Qs that are flirting with the trendline. So bear watching if you’re trading. (not recommended) And you can see the stop way down there at 47.79.

The real news is the metals.

As you can see SLV has fallen out of the rectangle and broken the trendline. The Basing Point is the bottom line of the rectangle. We think this is a Composite Operator inspired flushing operation intended to determine who is worthy to participate in the next wave up and will be buying when the dump-bump-dump-surge pattern is complete. Same with gold. You must determine if you want to sit through the flush. Regrettably this almost always proves to be the long term profitable thing to do. It is so annoying though to see them take back all those paper profits.

As you can see SLV has fallen out of the rectangle and broken the trendline. The Basing Point is the bottom line of the rectangle. We think this is a Composite Operator inspired flushing operation intended to determine who is worthy to participate in the next wave up and will be buying when the dump-bump-dump-surge pattern is complete. Same with gold. You must determine if you want to sit through the flush. Regrettably this almost always proves to be the long term profitable thing to do. It is so annoying though to see them take back all those paper profits.

This annoyance is considerably allievated though at the end of the day when you cash in on big trend profits.