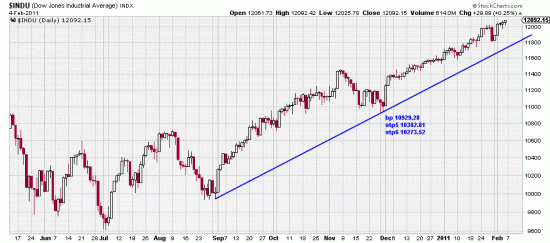

If you look at this chart of the Dow you have a perfectly healthy looking market. Prices are well away from the crucial trendline and way away from the Basing Point and stop. Matters of concern might be the air pocket fearful traders put in the market the 28th. This was because they can’t believe their good fortune–a 47 (now) day upwave. It makes them nervous. Coincident with the relatively long upwave was depressed readings in the VIX. High readings in the VIX make them nervous, and low readings in the VIX make them nervous.

If you look at this chart of the Dow you have a perfectly healthy looking market. Prices are well away from the crucial trendline and way away from the Basing Point and stop. Matters of concern might be the air pocket fearful traders put in the market the 28th. This was because they can’t believe their good fortune–a 47 (now) day upwave. It makes them nervous. Coincident with the relatively long upwave was depressed readings in the VIX. High readings in the VIX make them nervous, and low readings in the VIX make them nervous.

Another thing that makes them nervous is the mindless nattering of the pundits, talking heads and endless emails saying SELL NOW and such like. We occasionally amuse our graduate students by holding up a chart alongside some piece of misinformation or idiocy. The dollar is cratering (while the chart shows it rising). If those guys had to make a living trading instead of bloviating they’d be in a different business shortly–sweeping floors. And we don’t know which is worse — good looking babes analyzing Steeler defences or good looking babes analyzing the market. Spare us.

Now we have repeatedly warned about anticipating the market. Our last fellow trader who did that gave away a fortune in the Hunt silver market by selling too soon. So you have to bear through the downwaves. Bear up through the bears (oh, they’re at home watching TV).

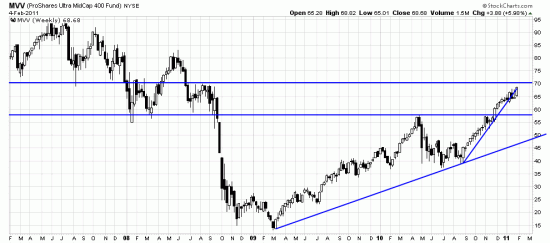

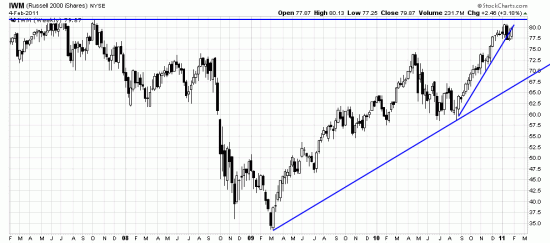

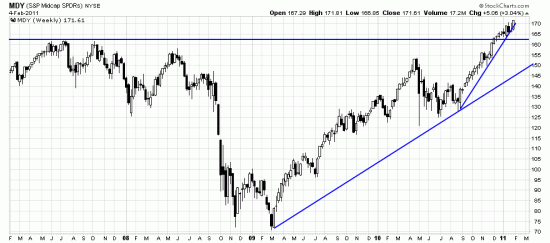

And it never hurts to look at some other things going on in the market to assess the status of the market. We have recently remarked on trend line breaks or cracks in some of the minor indices: IWM, MDY, MVV, and even the Qs have broken the line. Trendline breaks always have consequences, and we will either see these issues form sidewaves or decline.

MVV is in resistance and above some support. The Basing Point is at the December pullback low.

MVV is in resistance and above some support. The Basing Point is at the December pullback low.

The Russell is nose up against long term resistance, and has a broken short term trendline. The Basing Point is placed as in the Dow and the MVV.

The Russell is nose up against long term resistance, and has a broken short term trendline. The Basing Point is placed as in the Dow and the MVV.

The MDY, while it has broken the short term trendline has surged to a new high — which is positive. But given the length of the dominant market wave, as well as its own wave we wouldn’t be buying any here.

The MDY, while it has broken the short term trendline has surged to a new high — which is positive. But given the length of the dominant market wave, as well as its own wave we wouldn’t be buying any here.

The broken trendlines would seem to augur for some stormy weather but we think the likelihood of an attack more serious than that which occurred last April is remote in spite of the inner weakness of the minor indices. And –if you have any good short candidates some shorts in the portfolio is always wise.