Money makes the world go round, and the Berlin Cabaret is about to get more expensive. It’ll be the same number of euros, but each euro will cost you more to buy. The dollar will get cheaper. (Not for us. It will cost us just as much or more work to get it, but we will be like Spain in the 70s. Cheap.) That’s what happens when you have cheap politicians and a dysfunctional political process. Note that we do not include the Treasury and the Fed in this group. After all no one yelled at the little Dutch boy who put his finger in the dyke.

Money makes the world go round, and the Berlin Cabaret is about to get more expensive. It’ll be the same number of euros, but each euro will cost you more to buy. The dollar will get cheaper. (Not for us. It will cost us just as much or more work to get it, but we will be like Spain in the 70s. Cheap.) That’s what happens when you have cheap politicians and a dysfunctional political process. Note that we do not include the Treasury and the Fed in this group. After all no one yelled at the little Dutch boy who put his finger in the dyke.

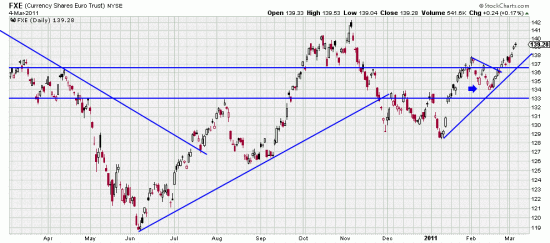

We have been long the FXE since the arrow. This is partly a chart analysis and partly an economic analysis. Surprise. You didn’t know we did that and we’re generally pretty covert about it. But with the lamentable state of the political economy we see the dollar getting weaker. FXE is one alternative to this. So is the Yen, XYJ.

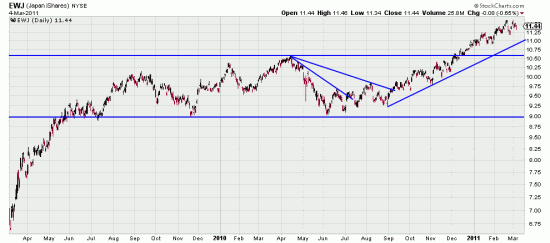

If the extended rectangle is any sign the yen might have a ways to go. There is also the Swiss franc. Those goat herders and gnomes just keep accumulating the Rhine gold and refusing to participate in European wars and economic follies. Their trains run on time, their streets are clean, their fondue is good. And their money is backed by gold. What a country.

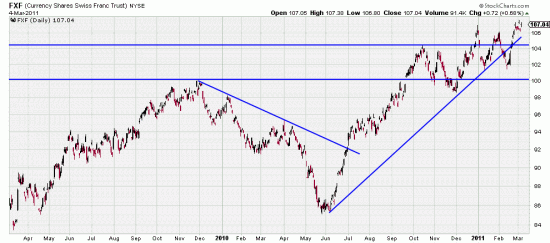

If the extended rectangle is any sign the yen might have a ways to go. There is also the Swiss franc. Those goat herders and gnomes just keep accumulating the Rhine gold and refusing to participate in European wars and economic follies. Their trains run on time, their streets are clean, their fondue is good. And their money is backed by gold. What a country.

In this case we have some misgivings. The SFranc is at the top of a long trend with some toppy looking patterns. This would be our third choice but we don’t see it tanking against the dollar.

In this case we have some misgivings. The SFranc is at the top of a long trend with some toppy looking patterns. This would be our third choice but we don’t see it tanking against the dollar.

Needless to say these are capricious markets. Don’t go in the water without a life vest, and don’t buy any of these without a stop. We looked at the Basing Points and saw this: Feb 14 134.02 in the FXE, Feb 24 11.19 in the EWJ, Mar 3 107.04 in the FXF. A 5% filter should keep you from going broke if it doesn’t work. We are, as said, already long the Euro and will get long some Yen this coming week.