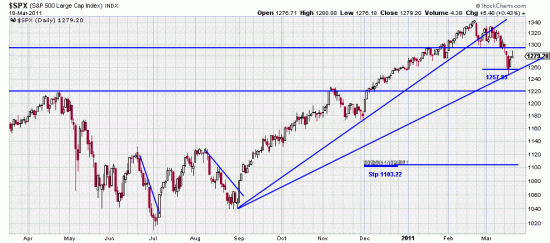

The SPX stop was tripped by .95. The market likes to do this. Pick your stop off and soar back up. What do you do? You hop right back on, and the context is always important. But usually you can lean on the power bar. Here two power bars may have canceled the probing black power bar down.

The SPX stop was tripped by .95. The market likes to do this. Pick your stop off and soar back up. What do you do? You hop right back on, and the context is always important. But usually you can lean on the power bar. Here two power bars may have canceled the probing black power bar down.

We remarked as this downwave was developing that stops based on downwave lows were inherently more conservative, and that was proven once again in this case.

With regards to the significance of this little tsunami all it proves is how nervous traders and investors are even in a bull market. The culture of musical chairs is so engrained that it represents the market paradigm. Basing Point investors can ignore this naked mud wrestling (or watch with amusement) and live much more serene lives — and more profitable lives too.

The technical significance is that the long term trendline from March 09 held up, and now the low of this downwave acts as an anchor point for a new shorter term trendline of gentler angle.

Whether this tempest in a japanese tea pot is over is not even certain yet, but once again the wisdom of the long term approach is demonstrated. We will not repost the Dow chart since it was posted just last letter.

We join in sympathy for the suffering of the Japanese people, a stoic, heroic and admirable culture.