http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=215498479

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=215498479

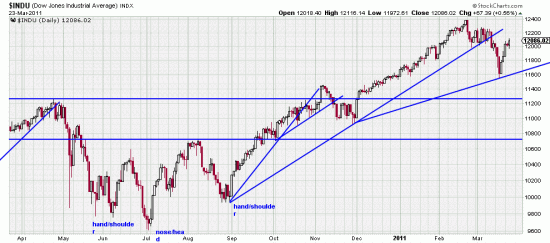

It is worth noting that today marks the third day away from the low made the 16th. As such the low serves as an anchor point for a new more gradual trendline. Also it considerably reduces the risk of longs made here. Naturally Your faithful correspondents didn’t wait for this or for the dump-bump-dump pattern to be fulfilled. We lifted our hedges on the bounce from the low, bought MJY (MJY is a typo. Correct symbol for Japan ETF is EWJ) and ORZCF (on a whim). That the market has withstood the lemming stampede for the exit and the elephants dash for the musical chairs and the malevolence of theoretical bears speaks well for market strength. There are those who would have, for personal gratification and profit, liked to have seen a hard bear wave. They were, and are, fighting the tape and what they don’t make in short profits they make up for in foregone long profits. These people are now our natural prey. They will be throwing in the towel and feeding us profits in the not too distant future. More importantly we will get to stick out our tongues at them and sing that most important of schoolyard chants: Nyah-nyah na nyah.

The bull market is still on.

These were recorded in the google group, johnmageeta. All readers should be members of this group as sometimes on the fly we make trading comments there.

Type your comment here…

Big options traders habitually monkey with the market to protect their options positions. I haven’t analyzed this phenomenon here to see if they are at it again. Because my approach is long term and these monkeyshines are beneath the level of my concerns. But obviously not for short term traders.

Good observation on your part.