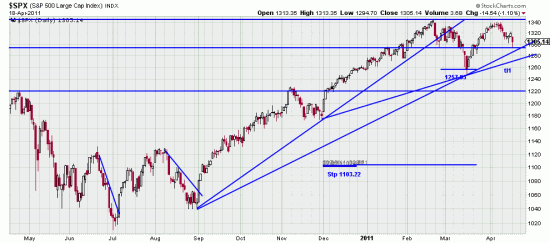

We remarked a few days back — about the 6th that a change of rhythm was occurring. And that certainly appears to be the case. After a little upwave of about 7% and 16 days the downwave we are in now began — now at 9 days and 3.334% in the SPX.

We remarked a few days back — about the 6th that a change of rhythm was occurring. And that certainly appears to be the case. After a little upwave of about 7% and 16 days the downwave we are in now began — now at 9 days and 3.334% in the SPX.

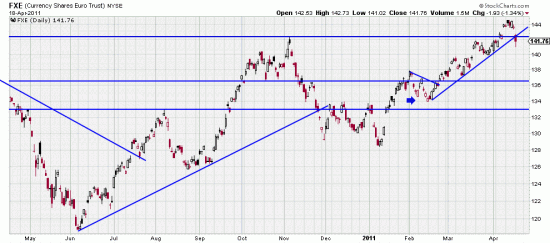

Other changes are the recovery of treasuries and yesterday the downgap in the euro.

Here we see it balking at the resistance line and evidently leaving an island reversal behind. The euro is the playground of big traders and powerful forces. They may just be shaking out the arrivistes and the ants (as in, when the elephants dance the ants….). Consider us shaken out for trading purposes. But they are constantly dancing on our heads and we are constantly running for cover. Smarter traders will have their trend stops under the Basing Point of Mar 29 of 139.93. 5% should do it. If it goes more than that they are really serious.

Here we see it balking at the resistance line and evidently leaving an island reversal behind. The euro is the playground of big traders and powerful forces. They may just be shaking out the arrivistes and the ants (as in, when the elephants dance the ants….). Consider us shaken out for trading purposes. But they are constantly dancing on our heads and we are constantly running for cover. Smarter traders will have their trend stops under the Basing Point of Mar 29 of 139.93. 5% should do it. If it goes more than that they are really serious.

Of interest as we assess the general market situation this little downwave has the effect of making a tidy looking little Kilroy (reverse H&S). If this is valid we should see the bull market resume and punish the shorts and doom predicters. There is a sizable population which would like to see the market tank for personal vindication and profit. We would like to see them hurt. Nothing personal. Just business as they say in The Godfather.