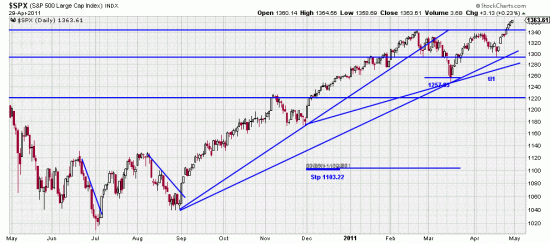

Here is a good picture of where things are really at. Pundits, talking heads and shorts rejoice each time we get a downwave thinking that THIS IS IT, THE BEGINNING OF THE END! Not realizing that it’s just a downwave. This little downwave was about 2.87% in 9 days. If you’re short and you’re taking comfort in these little waves you will soon be broke, because the bull response to this was a 9 day upwave of 6.11%.

Here is a good picture of where things are really at. Pundits, talking heads and shorts rejoice each time we get a downwave thinking that THIS IS IT, THE BEGINNING OF THE END! Not realizing that it’s just a downwave. This little downwave was about 2.87% in 9 days. If you’re short and you’re taking comfort in these little waves you will soon be broke, because the bull response to this was a 9 day upwave of 6.11%.

An upwave that is still in force –though — it stands to reason that the coming week will see some profit taking and once again the effort of contrarians to stem the advance. Let us once again make clear that we are neither bulls nor bears, but advocates of whatever the current major trend is. And, obviously, traders within the major trend.

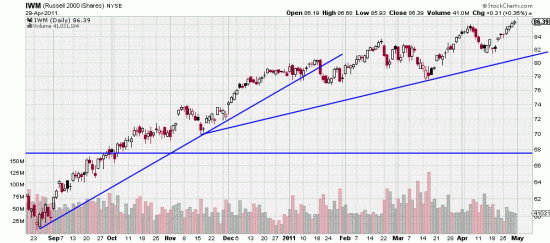

Repeating, our goal is to beat the market, realizing the gains of the long major trends and shorting the market when bear trends manifest themselves. Usually we do this with the major ETFs, but it is worth noting that we have no prejudices against other important lesser ETFs, e.g., IJK, MVV and IWM. Some capital deployed into these instruments can be good strategy, and over the the next year or so might be more profitable than the majors.

Here the IWM. As always, when one enters a strong long trend capital is divided into tranches — 3 to 7 committed over time and on signs of strength, or after downwaves have been completed.

Here the IWM. As always, when one enters a strong long trend capital is divided into tranches — 3 to 7 committed over time and on signs of strength, or after downwaves have been completed.