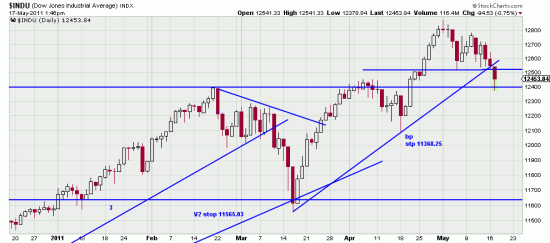

To start with we don’t like the way things are shaping up here. A minor trendline just broken in the INDU — in fact two broken, the horizontal and the sloped. From a trading point of view we are exiting our positions in the indices. We think investors should begin thinking of hedging. You can hedge in units, or partially — for example, 1/3, 1/3, 1/3 — or similar.

To start with we don’t like the way things are shaping up here. A minor trendline just broken in the INDU — in fact two broken, the horizontal and the sloped. From a trading point of view we are exiting our positions in the indices. We think investors should begin thinking of hedging. You can hedge in units, or partially — for example, 1/3, 1/3, 1/3 — or similar.

We don’t think (remember when we say we think it doesn’t mean we are thinking. It means we have made an analysis and are delivering oracular pronouncements, as from the Delphic tripod. (How did they sit on that thing anyway? No wonder they were sniffing something intoxicating.) So don’t accuse us of thinking.) (thought resumed) we don’t think the major trend has changed. But the signs say that momentum is down for the moment. The game has changed this inning. I told the Giants to lift Tim and they couldn’t hear me yelling from the stands. They should subscribe.

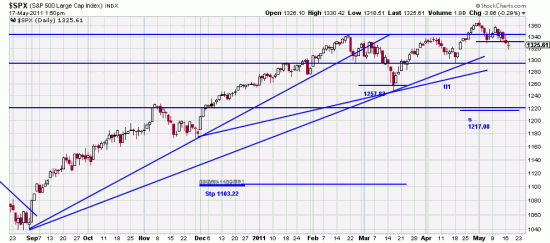

Anyway the game is different this inning. The SHY and the TLT are headed North while the stock sled dogs chase their tails in circles. This is true in the major indices: here SPX

We have said repeatedly that equity ebbs and flows in a trend. And that wise long term investors accept this fact and shun struggling when the ebbing starts.

We have said repeatedly that equity ebbs and flows in a trend. And that wise long term investors accept this fact and shun struggling when the ebbing starts.

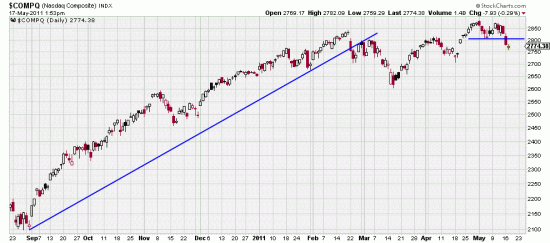

Same symptoms in the Q’s

You can hedge with DOG, QID and SPXU, or puts. Just be alert to what is happening, look to your stops and hope for a good bull pen pitcher.

You can hedge with DOG, QID and SPXU, or puts. Just be alert to what is happening, look to your stops and hope for a good bull pen pitcher.