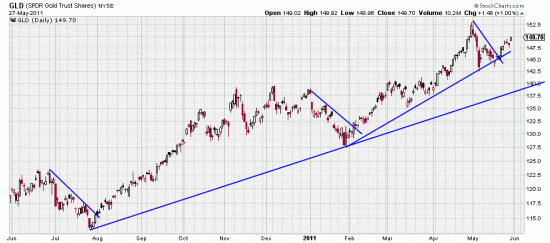

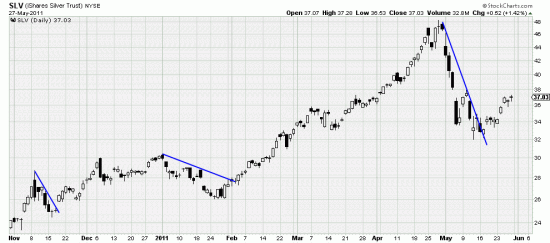

The silver and gold markets appear to have stabilized and to be buyable. We’re not wild about the abg-z pattern, but such as it is it seems positive for reestablishing positions — or even for adding on. The reason we’re not wild about it is the weakness of the beta wavelet, and the resulting sharply angled downtrend line.

The gold and the silver look similar in this respect.

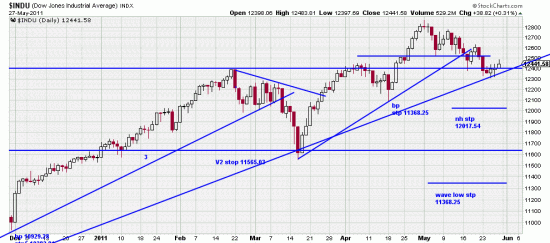

Meanwhile prices continue to hover over the March 09 trendline and the entire pattern since February looks like a big sidewave with some hints of a broadening formation. As we have said before the breaking of this trendline will have serious consequences. It could be that the sideways wave going now will presage more sideways and the market will swing into a broad trading range. The alternative is a serious downwave. We attribute the state of the market to the state of the economy. You can’t have a housing market sliding South on its way to Patagonia, and unemployment levels rivaling Tunisia and have a healthy market.

Consequently investors have gone to bonds and metals. While we are watching the major indices readers should be watching their individual stocks for broken trendlines — or for violated Basing Points. If in doubt about individual issues post the chart to the edwards-magee google group and we will comment on it.

i don’t use targets.

In general I don’t use targets. The market tells me when to get out. target trading cuts your profits short, which is no fun