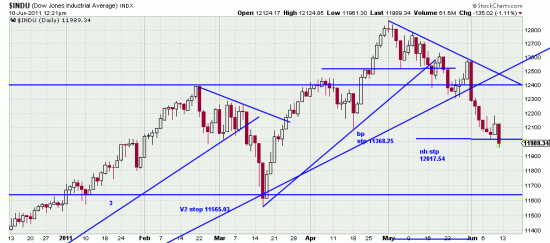

All the omens are bad — said the Delphic oracle to Cyrus… The Dow Theory just threw off a sell signal, the long term trendlines from March 09 (!) are broken and today the Basing Point New High Variant 2 stop is taken out. As is obvious the wave low Variant 1 stop is alive, but not well. It is sweating bullets as it watches a train bearing down on it. You can see it skulking just at the bottom of the chart.

Last time the New High Variant 2 stop was threatened we shrugged it off. We have already taken it seriously in this case. The breaking of a trend line of 26 months is an event of major import. And it will export major consequences. This will not solve, but exacerbate the nation’s export-import problem.

It will also export major amounts of cash from your portfolio.

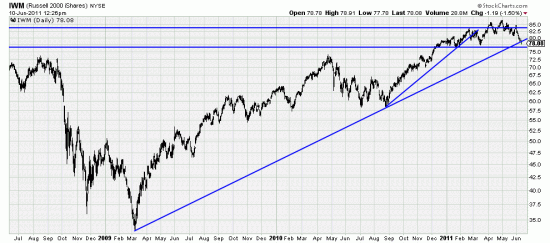

this problem is not limited to the Dow. All (ALL) the major indices are broken. SPX, OEX, IJK, IWM, MVV.

While this is the IWM it looks just like all the indices.

While this is the IWM it looks just like all the indices.

We never tell our readers to do this or to do that — or to take the Variant 2 stop or the Variant 1 stop. It is not impossible that prices will arrest and reverse before the Variant 1 stop is taken out. We do tell our readers to be awake, and not to sit through a bear market.

We love our readers and would be very lonely without them.