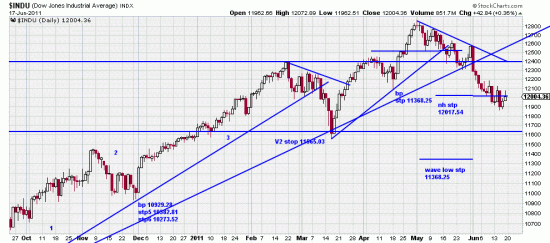

We are now in a 35 day downwave which is 7.87% down from the top. It has tripped the Variant 2 new high stop, but, as may be seen from the chart the Variant 1 stops are still someway down (about 4%). Over the past two months we have been urging readers to find some shorts or to look to hedge their positions. AND those investors who are sitting with the Variant 1 stop in place may be laughing at those of us who traded and who took the Variant 2 new high stop.

We are now in a 35 day downwave which is 7.87% down from the top. It has tripped the Variant 2 new high stop, but, as may be seen from the chart the Variant 1 stops are still someway down (about 4%). Over the past two months we have been urging readers to find some shorts or to look to hedge their positions. AND those investors who are sitting with the Variant 1 stop in place may be laughing at those of us who traded and who took the Variant 2 new high stop.

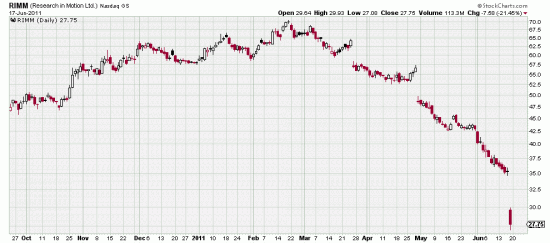

Among short candidates we pointed out were RIMM and NOK. RIMM gapped down 21% this week. This is about as surprising as snow in December in Alaska (You know –the place you can see Russia from.) It had two previous downgaps and was in a pronounced downtrend. We have said repeatedly that catastrophic risks like this are totally foreseeable. In this chart this collapse has been telegraphed at least twice. And readers who shorted it now have some revenge for this major index downwave.

More of these patterns will occur.

More of these patterns will occur.

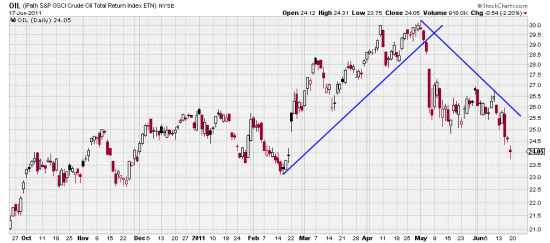

In fact look at OIL:

Oil has been a shell game market for months. Now the shells are coming home to roost.

Oil has been a shell game market for months. Now the shells are coming home to roost.

The other shell game market is, of course, IPOs. Linkedin topped at 106 and is presently 65 and we probably should have shorted it on IPO day and it is still shortable. We have nothing but contempt for the snake oil the Wall Street snakes are selling to the public. Groupon. Gag me with a spoon.

What happened to Dean Witter and E.F. Hutton who personally had integrity –even if their successors didn’t? The firms disappeared because they lost their integrity.

Most readers are probably too young to remember the tag lines suggested by wags of these: Drexel

Burnham (It’s better in the Bahamas.) Hutton (When E.F. Hutton talks, people lose interest.) Not a lot of difference between most of Wall Street and Bernie Madoff. Except Bernie got caught. We used to have a slippery broker who was fond of saying: The 11th commandment is, Thou shalt not get caught. That one is number 1 on Wall Street now. Number 2 is, thou shalt not sext the Chairman of the Fed.