The market is sailing blithely on both — the Nile of disbelief and on denial of reality. This may be no surprise. After all when college educated (?) politicians deny climate change science and act like abstinence will solve the problem of teen age sexuality who would expect them to be attached to reality when it comes to the country’s financial problems?

The market is sailing blithely on both — the Nile of disbelief and on denial of reality. This may be no surprise. After all when college educated (?) politicians deny climate change science and act like abstinence will solve the problem of teen age sexuality who would expect them to be attached to reality when it comes to the country’s financial problems?

Unfortunately we investors have to stay closely attached to reality. If the market takes a swan dive here August 3 denial is not going to be an option. (Oh, there’s an option — puts.) Oh well, we can do what we always do and rush to saftey and buy US bonds. Say what?

We have just illustrated the confusion and chaos which will occur if the debt limit is not raised. Flee where? No safe harbors?

That is why we are long gold and the VXX. And flat virtually everything else. The market is in disbelief and denial about what is going on in Washington. Maybe they’ll get it done (we don’t care who’s to blame — a plague on both their houses). And, of course, there are always Nigerian bonds and bonded Kentucky bourbon.

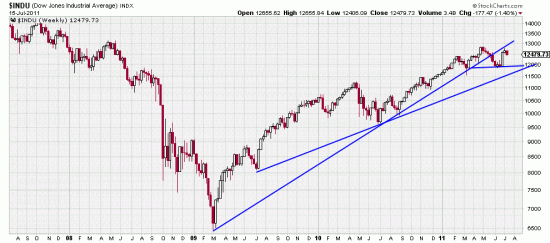

The critical nature of the situation is illustrated by the break in the March 09 trendline which we have been harping hysterically (well, we try to remain calm while being hysterical) about for weeks. Prices have pulled back to the trendline, a frequent occurrence. One of two things (or three) happens at the break of a trendline of this major significance — 1. The market takes a swan (black) dive on its way to Australia; 2. The market thrashes sideways for a long dispiriting period. 3. After discouraging and demoralizing the general public market blasts back into space to visit the Hubble.

Valid and reasonable tactics at present: Hedge completely. Stand by your Basing Point stops. Buy some insurance: gold, silver, VXX, puts. Go to the sidelines and watch with interest like a spectator at a NASCAR race waiting for a multi-car pileup. Invalid tactics: large exposure.

Invitations to astute technical analysts will be issued prior to the blast-off.