People just beginning to talk about the head and shoulders formation (CNBC, Drudge) are late to the party and will find that no chairs are left in the musical chairs game.

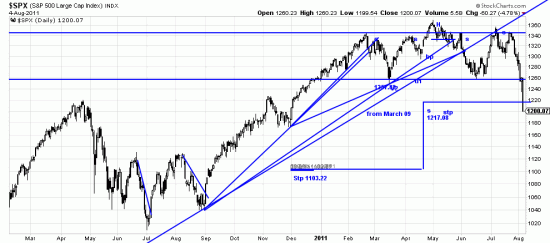

Not only that, they have evidently been blissfully ignorant of warning signs which have been flashing since February. February 23 ’11 we pointed out to our readers that a 94 day trendline from December 1 ’10 was broken. March 11 ’11 we pointed out that a 193 day trendline from August 31 ’10 was broken. May 20 the trendline from March 20 was broken. As if this weren’t enough on the first of June the 727 day trendline from March of ’09 was broken. Of interest the ’09 trendline almost intersected with the trendline from December 1 ’10. No technician could have been long or talking about buying after that. Through this period we constantly harped at our readers that they should be hedged, scaling out, shorting individual issues, or going to the sidelines.

As we said at the time, bad things happen when long term trendlines are broken.

Through this period it became obvious that a top was being put in, and finally there was no contesting the fact that it was a head-and-shoulders top.

All of this was done with a ruler and a chart. Anyone with a ruler and no prejudices could have done the same thing.

We are short the SPX and tossed our gold position today.

REaders should be acutely aware that the game has changed the last several days. We are no longer in a sidewave — which was incidentally a head and shoulders formation. We are now in a downtrend. It is folly to hold long positions that have violated their stops in a downtrend. It is folly to attempt to buy “cheap stocks”. Today edwards-magee stops are definitively taken out, if you have not already taken our hints to hedge or scale out. Some ideas as to where the market may be headed are in our letter several posts ago on targets.

A feature of modern markets is how quickly the moves materialize. Investors and speculators must respond quickly to technical signals, otherwise they’ll find themselves entering late in the move. For example, I would argue that to get short now would require a rally to old support, now resistance. We are just way too far from a basing point and would be risking too much capital to dive in right now on the short side. Even those who are still long might benefit by waiting to exit, although I would feel physically ill to be long this market.

congratulations! Your call was accurate as a Swiss watch.

Superb analysis! But why tossing gold? The chart is steady.