Courtesy of Robert Shouet (we don’t even look for these kinds of statistics) a member of a chat group we read: Morning Fri: decliners exceed gainers 16.67-1. Not to worry. Afternoon gainers exceed losers 16-1. NYSE NET decliners were -1922 morning and afternoon were +2055.

Courtesy of Robert Shouet (we don’t even look for these kinds of statistics) a member of a chat group we read: Morning Fri: decliners exceed gainers 16.67-1. Not to worry. Afternoon gainers exceed losers 16-1. NYSE NET decliners were -1922 morning and afternoon were +2055.

We have often described these kinds of markets as bungee markets.

You cannot compete in these markets against New York trading rooms and flash traders. But you can outsmart them by not playing a game you can’t win. Sometimes we look at the intra day data. NY can move the market hundreds of points in two minutes.

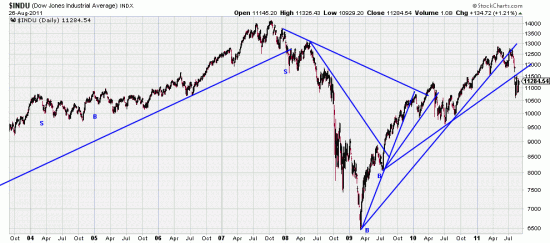

A better way to look at the market is as above — ’04-11 — where you can see the great tides of the market. This letter has consistently, using the methods of Edwards and Magee, been on the right side of these tides. Now, as Irene pushes waves ashore to punish unbelievers and infidels the market is handing out similar punishment. Repent.

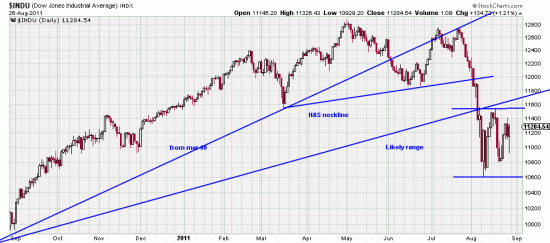

Or, at least, if you’re not going to repent (we’re not) enjoy the event. Because it’s unlikely you are going to see any profitable trends anytime soon. In fact what you are likely to see for the foreseeable future is naked mud wrestling and knife fighting. We have marked the likely congestion zone on the next chart.

10500 to 12000 is pretty restricted so 3 or 4% on either side is a good fudge factor.

10500 to 12000 is pretty restricted so 3 or 4% on either side is a good fudge factor.

Have you thought about dividend stocks? We have. Quite some time ago we analyzed a list which bore up astonishingly well in the great Bush bear market (we , as a matter of style, identify the market with the president who was on watch. We despise both parties equally.). In the near future we will look at some dividend stocks again. Present readers are probably all too young to remember when investors bought stocks for dividends.

Yes, children, there was such a time, and music was played at levels that didn’t destroy your eardrums and men wore boaters and white flannels. Ah, Ou sont les nieges d’antan.