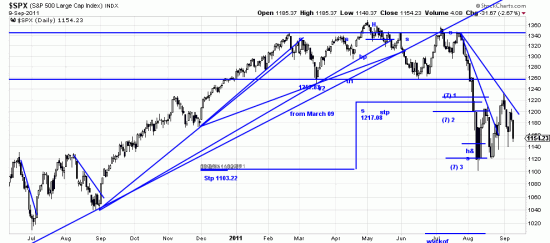

Sometimes in the hurly-burly of bungee markets we get absorbed in the detail and the trees falling on us and forget the forest. Well, the forest is still there and it is still more important than the trees. Here is a look at the forest, above. So let us recapitulate what good lumberjacks should be doing. If one were managing the forest with the edwards-magee methods he would have liquidated his long positions as shown at the stairstop, 1217.08, and gone short. Study after study has emphasized the importance of shorting the market on major trend changes — which this is.

Sometimes in the hurly-burly of bungee markets we get absorbed in the detail and the trees falling on us and forget the forest. Well, the forest is still there and it is still more important than the trees. Here is a look at the forest, above. So let us recapitulate what good lumberjacks should be doing. If one were managing the forest with the edwards-magee methods he would have liquidated his long positions as shown at the stairstop, 1217.08, and gone short. Study after study has emphasized the importance of shorting the market on major trend changes — which this is.

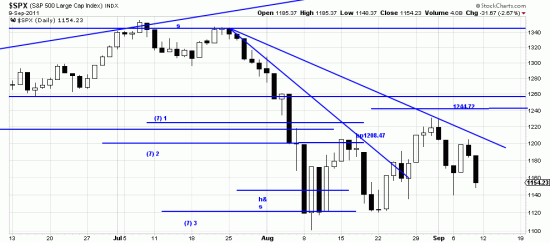

As for what is going on right now, which we have characterized as naked mud wrestling, it is naked mud wrestling. Also, back alley knife fighting. The E&M trend follower has his stop above this nonsense at 1244.72. At that point you liquidate your shorts and go long again.

Here the Basing Point and stop are illustrated, and, as is obvious the trend follower looks down with disdain on the frantic trading going on below. Readers may extrapolate this analysis to the Dow and other markets.

Here the Basing Point and stop are illustrated, and, as is obvious the trend follower looks down with disdain on the frantic trading going on below. Readers may extrapolate this analysis to the Dow and other markets.

Does this mean that further downside waves are in order? (Worth noting that the final target of the rule of seven calculation –903– has not been achieved.) Probably, but only the crystal ball knows and Barron’s and the WSJ and Marketwatch and the punditry and talking headery have got hold of it and won’t share it with us. Lucky us.

But we know with a high degree of certainty what the immediate future holds: more of the same. And will hold until the outer edges of this struggle are decisively violated. What is it? It is not a flag. But it is either a reversal or a continuation pattern and it is impossible to know at the moment which.

The soundtrack of this letter is: “I’m a lumberjack and that’s ok. I sleep all night and I work all day…”