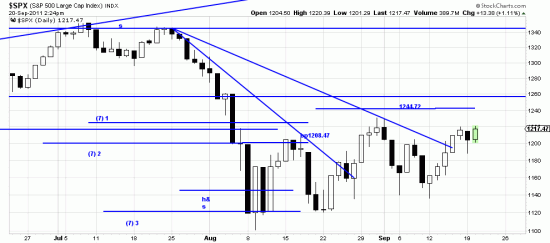

The purpose of weeks like last week is to inspire hope in investors who are clinging to their stocks. An old Wall Street nostrum has it that the market climbs a wall of worry and slides down a slope of hope. Not for our readers. Reality is the only thing that counts here, not opinions and forecasts and bargain stocks to scarf up. The seven day up wave is kaput, dead, history –The last bar here was taken before the market turned down and finished in the red.

If you just count the wave pattern here that’s about all you could expect of it. So the present trend tends to continue. The energy being built up here will cause some violence at some point. We don’t like to predict when, as we hate egg on the face. Actually you might say that some violence is already being done with 4 and 500 point days. you can get yourself a t-shirt that says I survived the rectangle, congestion phase, trading range, market volatility (pick one) of summer 2011.

This theme continues, and there are some other new leitmotifs peeking through the charts.

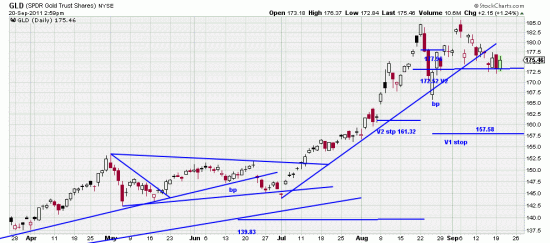

If the market and dollar go up, gold goes down, right? We don’t have any predictions, except to say there is a broken trendline and we are out of it. While it may not plummet (or might) the likelihood of further appreciation is unlikely. Stops are marked for Versions 1 and 2, and you can see the long term trend stop is a long way away. Somehow those positions where we just sit and let the wave come back always wind up more profitable in the long run.

If the market and dollar go up, gold goes down, right? We don’t have any predictions, except to say there is a broken trendline and we are out of it. While it may not plummet (or might) the likelihood of further appreciation is unlikely. Stops are marked for Versions 1 and 2, and you can see the long term trend stop is a long way away. Somehow those positions where we just sit and let the wave come back always wind up more profitable in the long run.

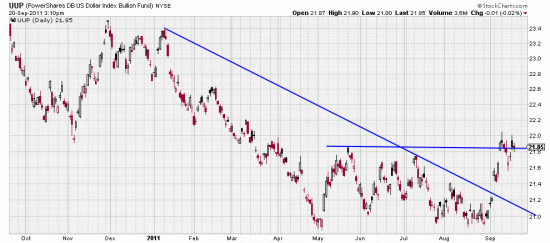

If the dollar is ever going to go up this is the way it starts. At the least for a technician it’s worth a trade — and perhaps will turn into a real trend. Gaps, broken trendlines –sloped and horizontal.

If the dollar is ever going to go up this is the way it starts. At the least for a technician it’s worth a trade — and perhaps will turn into a real trend. Gaps, broken trendlines –sloped and horizontal.

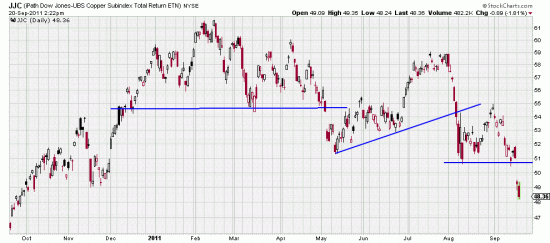

While that is happening copper is a short. This does not augur well for the economy, ours, and theirs.:

Classic signal. Gap and power bar.

Classic signal. Gap and power bar.

While the market continues sideways the trend in copper is pessimistic, and it looks like the European situation is sorting itself out with the flight to quality being in the dollar and US Bonds. Strange.

Utmost alertness is required at present. The market turns on a pfennig and there are no chairs to sit on when the music stops for traders.