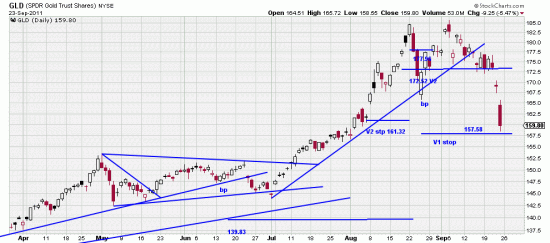

Our letter last week in gold was singularly well timed. And illustrates a valuable lesson. Don’t wait around. Something bad might happen. Traders would now be justified in being short gold and silver, and as may be seen here the long term stop is being threatened. If the threat is realized it would be unwise to ignore it.

Our letter last week in gold was singularly well timed. And illustrates a valuable lesson. Don’t wait around. Something bad might happen. Traders would now be justified in being short gold and silver, and as may be seen here the long term stop is being threatened. If the threat is realized it would be unwise to ignore it.

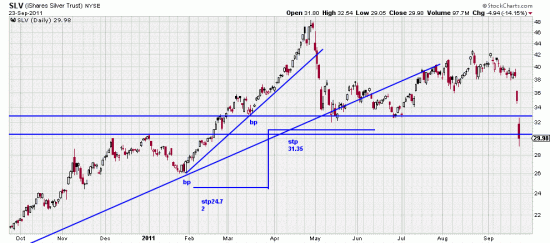

The stop is already violated in silver. Given the violence of these moves it would be unwise to look at these moves as “buying opportunities”. These prices are opportunities to get your head torn off.

The stop is already violated in silver. Given the violence of these moves it would be unwise to look at these moves as “buying opportunities”. These prices are opportunities to get your head torn off.

Since the flash sell off of August (three days) gold acted strange to us. (sic. strangely, for you English majors.) Obviously what was going on was distribution and sneaking out of the market on the part of some big holders. Last Thursday they came out of the closet and hammered the market.

Repeating our admonition above: Sitting on a position when its behavior is “strange” or unexplainable is a good way to lose money. Especially in markets like gold and silver which have been the object of much speculation.

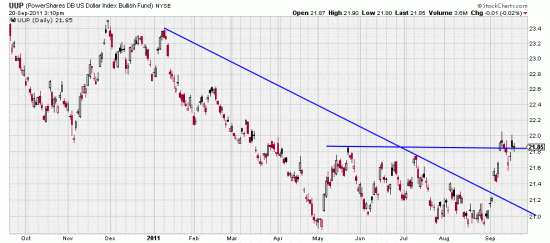

On the other hand, as Truman’s economist used to say, the dollar is a beneficiary of the turmoil, and probably will continue to be so.

Not only does the economic story make sense, the chart makes sense: broken trendline, broken resistance line. Paniced Europeans, Greek gods throwing thunderbolts in all directions, DSK admitting moral fauilts, Europe bathing in moral hazard, the Congress back threatening to shut down the government….

Not only does the economic story make sense, the chart makes sense: broken trendline, broken resistance line. Paniced Europeans, Greek gods throwing thunderbolts in all directions, DSK admitting moral fauilts, Europe bathing in moral hazard, the Congress back threatening to shut down the government….

For the ignoble prize who said history repeats itself, first as tragedy and then as farce? And for a bonus, who turned Hegel upside down?