We booted our long trade in the SPX Friday as we analyzed that the upwave was ending. Pretty short upwave. 3 days. (7% profit) Now we are betwixt and between. If we take out the last high, 1194.62, we will be stuck in the massive sidewave here. If Friday’s high holds and we see three days away on the downside get set for the bobsled ride to the next recession. We have already pointed out the developing pattern of lower highs and lower lows –two so far. If Friday becomes another point the bull’s goose is cooked. The death throes of the bull are written all over this formation. The only thing that can save it is a desperation wave above 1240.

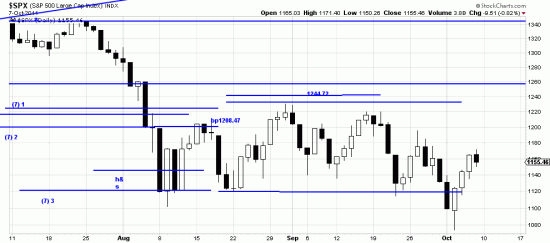

We booted our long trade in the SPX Friday as we analyzed that the upwave was ending. Pretty short upwave. 3 days. (7% profit) Now we are betwixt and between. If we take out the last high, 1194.62, we will be stuck in the massive sidewave here. If Friday’s high holds and we see three days away on the downside get set for the bobsled ride to the next recession. We have already pointed out the developing pattern of lower highs and lower lows –two so far. If Friday becomes another point the bull’s goose is cooked. The death throes of the bull are written all over this formation. The only thing that can save it is a desperation wave above 1240.

In general we never put on our economist’s hat (it’s too small and it’s a Dobbs and only holds 5 gallons). But it is not hard to see that the market reflects investor judgment on the fundamental economic and political situation. This being the case, why wouldn’t we see lower prices — Perhaps painfully lower prices.

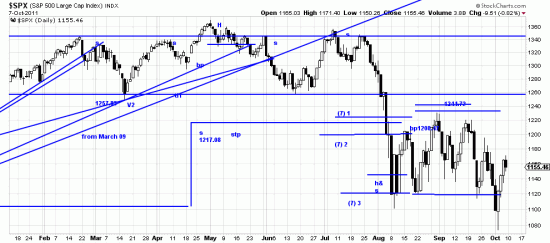

Here is the big picture:

Here we see the stairstops leading up to the plunge, which the prudent investor disregardeth at his peril. We also see the target stops calculated before the plunge. Just in case you are harboring an ember of hope let us warn you that we are about to recalculate those targets which will result in even more pessimistic targets. As if the previous weren’t pessimistic enough–target 4 being 903.

Here we see the stairstops leading up to the plunge, which the prudent investor disregardeth at his peril. We also see the target stops calculated before the plunge. Just in case you are harboring an ember of hope let us warn you that we are about to recalculate those targets which will result in even more pessimistic targets. As if the previous weren’t pessimistic enough–target 4 being 903.

We attribute these sharp rallies to investors who do not understand what is going on –indeed, covers of Barron’s which tout three stocks to buy now — and Marketwatch (Altucher) three stocks which will double (Microsoft????? — yes, as soon as they buy Apple)– and to big put sellers who are protecting their positions.

Good luck in holding back the flood and pray for the levies to hold.