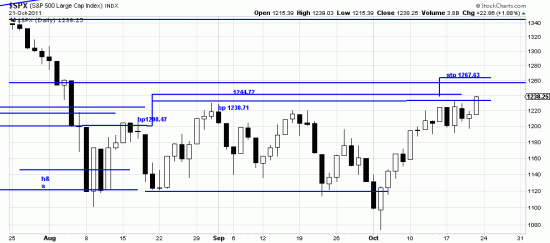

As prices in the SPX move out of the five day congestion — and perhaps out of the 53 day congestion — it is time to think about hedging against upside markets. Numerous commentators consider the piercing of 1230 significant. What we think of it is shown by the chart. Not yet. But close enough to think about. And certainly close enough to hedge — i.e., by venturing some longs or lifting some short hedges.

As prices in the SPX move out of the five day congestion — and perhaps out of the 53 day congestion — it is time to think about hedging against upside markets. Numerous commentators consider the piercing of 1230 significant. What we think of it is shown by the chart. Not yet. But close enough to think about. And certainly close enough to hedge — i.e., by venturing some longs or lifting some short hedges.

It is a very mixed and ambiguous picture. The penetration of the boundary line does what? puts prices head to head with all the resistance represented by the head and dhoulders top and all the activity that occurred there. We would not vote for easy sailing — not mention — did you forget? Angela and Sarko and Sophocles and the Greek tragedy (comedy?). And the Civil War in Washington, and the suicide bombers in the Senate. And 14 million jobless and the millions of houses that the banks own –to their chagrin and distressing margin.

But we lapse into satire (and rhyme (of a doggerel sort), which is about all this market is good for.

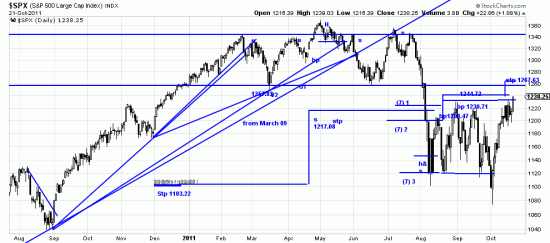

Here is the long term picture which everyone seems to have forgotten, illustrating where that long horizontal line came from:

While some long side hedging might be in order, our stop above that line appears to us to be very strategically located. It is a bit more than 3 percent above the boundary of the congestion pattern and it very nearly coincides with the Basing Point calculated stop from the alternate Basing Point we recently suggested. Break those stops and we are bulls. Worth remembering: Before they take the market up they take it down to flush out the undeserving.

While some long side hedging might be in order, our stop above that line appears to us to be very strategically located. It is a bit more than 3 percent above the boundary of the congestion pattern and it very nearly coincides with the Basing Point calculated stop from the alternate Basing Point we recently suggested. Break those stops and we are bulls. Worth remembering: Before they take the market up they take it down to flush out the undeserving.

It is difficult for us to imagine that the market would be so accommodating as to give us true signals at this point. But anything can and does happen in these markets. And will.