We have been reading “The Great Game” (and also “Flashman” comic masterpiece about Afghanistan). These recount the struggle for empire between the Russians and the British in the 19th century. Tales of deceit, treachery, betrayal and brutality. An apt metaphor for our current markets. We read one account (of the market, not the Great Game) in which the analyst said in sum that everybody with any sense was on the sidelines and it was the flash traders and the hedge funds who were banging each other. Could be. Jibes with our observation anyway.

We have been reading “The Great Game” (and also “Flashman” comic masterpiece about Afghanistan). These recount the struggle for empire between the Russians and the British in the 19th century. Tales of deceit, treachery, betrayal and brutality. An apt metaphor for our current markets. We read one account (of the market, not the Great Game) in which the analyst said in sum that everybody with any sense was on the sidelines and it was the flash traders and the hedge funds who were banging each other. Could be. Jibes with our observation anyway.

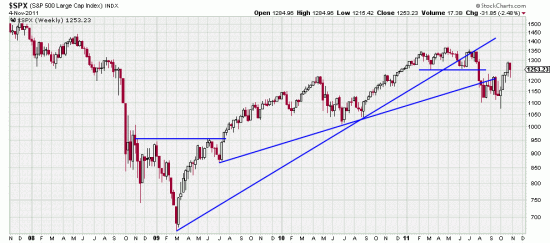

First the long term picture: Little attention has been given the breaking of the long term trendline from July of 09. The market noticed it and that is one reason for the deceit brutality and treachery we have been experiencing lately. The flash players and hedge funds are playing the part of the Afghan tribes. In case you hadn’t noticed the hedge funds and famous managers are falling like flies. Only the super agile have profited in this period.

We think large questions continue to haunt the market (What do you expect from Halloween, dia de los muertos, and Athens (if ever Marx was right he was right about Athens, and that history repeats itself, first as tragedy, then as farce. Except that Italy has been repeating itself over and over as farce after farce after Burlusconi.))

Wasn’t it Malraux who said that people get the kind of government they deserve? But does that mean we have to get the markets they deserve?

The only insulation from this farce is to take the very long range view. Our systems are long at the moment with a large filter against this nonsense.

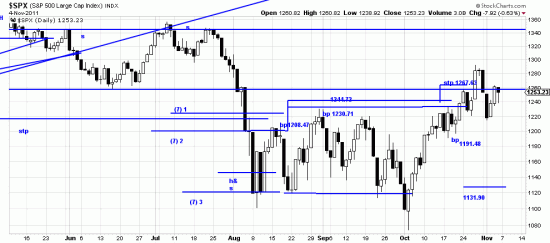

The double whammy of the two trendlines from 09 has bewitched the markets and may still be bewitching it. The last few days may be just an incidence of the famous “throwback” to the exit line or it could be the tragedy of a broadening formation or the farce of two traps, bear and bull. In all likelihood the present trend will continue. Oh, which one is that? Sometimes it’s damned difficult to tell, and this is one of those times. Could be the abortive flag, or could be the sidewinder (with some pretty sharp fangs) that started in August.

The double whammy of the two trendlines from 09 has bewitched the markets and may still be bewitching it. The last few days may be just an incidence of the famous “throwback” to the exit line or it could be the tragedy of a broadening formation or the farce of two traps, bear and bull. In all likelihood the present trend will continue. Oh, which one is that? Sometimes it’s damned difficult to tell, and this is one of those times. Could be the abortive flag, or could be the sidewinder (with some pretty sharp fangs) that started in August.

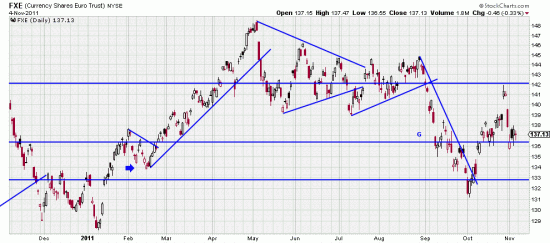

Gold and silver look buyable, and the FXE euro doesn’t. One protection against butchery is small positions. So we are long very light trades (note, trades, not investments) in the gold, silver and SPY.

In fact it has an island reversal in it.

In fact it has an island reversal in it.

If you have a short attention span or ADD or ADHD you have to be wallowing in paradise. Oh, well, as Oscar Wilde said there’s little comfort in the wise, this side of paradise.