By all rights the explosion represented by the last 6 trading days (8.15%) should be the kickoff for the upward trend — and it may be. But next week Geithner and the European pooh-bahs will be creating meaningless news in Europe, and that news could either blow the markets away on the upside or sink it to the bottom of the Aegean (a sea close to Greece) (too close).

By all rights the explosion represented by the last 6 trading days (8.15%) should be the kickoff for the upward trend — and it may be. But next week Geithner and the European pooh-bahs will be creating meaningless news in Europe, and that news could either blow the markets away on the upside or sink it to the bottom of the Aegean (a sea close to Greece) (too close).

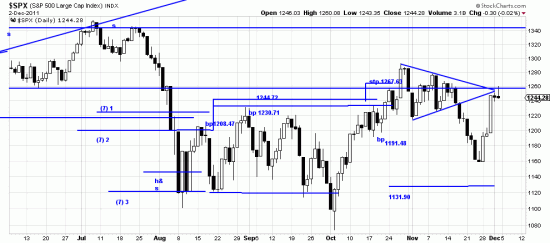

In a market dominated by flash traders and hedge funds a 6 day wave is like a secular bull market. But what we have is a monster side wave since August with a bear trap at the bottom and a possible bull trap at the top. Thus, more of the same. The only strategies working are our favorite one — stand so far back with wide basing point stops and watch the snakes bite each other to death, or watch the two minute bars and trade. Our strtegies we speak of.

The snakes are down at the nano second level with automated algorithms looking for pennies. This is not a healthy market and if we had regulators and politicians worth a teenie these snakes would be taxed out of existence.

But like everything else (except the dysfunctional Congress) (dysfunctional? psychotic!) it will end, and of course we will have a new bull market. A long term perspective on the market is that it is adjusting to the March 09 trendline break — the sloped line seen at the upper left hand side of the chart. Break a 700+ day trendline and you have to spend some time making a down wave and then a sidewave. In the process you give up some equity and get nicked and irritated but sooner or later the train gets back on the tracks. In the meantime risk control is what enables you to be around when the train gets righted– and it will.

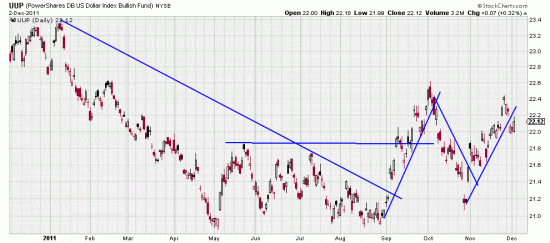

It looks like the dollar has topped this wave:

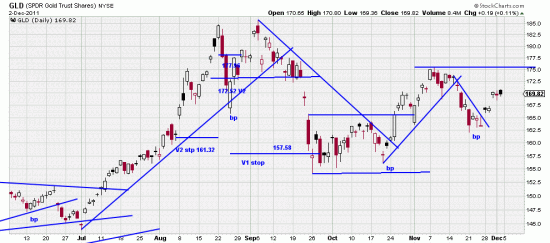

Broken trendline. Island reversal. But gold might be worth a small scale in trade:

Broken trendline. Island reversal. But gold might be worth a small scale in trade:

A couple of gaps — which may or may not be significant. For our own accounts we will wait for the horizontal line to be taken out — unless we see something else interesting. But aggressive traders might want to start scaling in. We don’t think the long gold bull market is over. But Herman Cain is.

A couple of gaps — which may or may not be significant. For our own accounts we will wait for the horizontal line to be taken out — unless we see something else interesting. But aggressive traders might want to start scaling in. We don’t think the long gold bull market is over. But Herman Cain is.