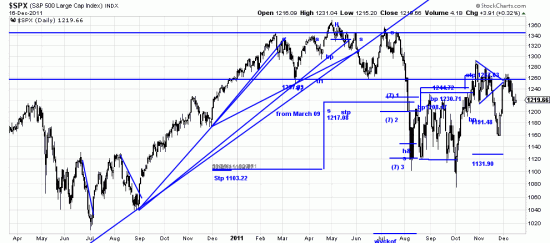

Some may say that it is zombie politics cursing the markets, and they would be right. Not just the living dead politics of Washington, but of Berlin and Paris also in this case. But the real curse of the markets is the March 09 trendline which, with the cooperation of the brain dead politicians, holds sway over the market. For all practical purposes most issues are in sideways trends. Only idiot savants, traders and cheaters make money in these markets. Some savants — idiots or not — have been touting the Russell 2000 — and it’s not totally a bad idea to have a piece of it.

Some may say that it is zombie politics cursing the markets, and they would be right. Not just the living dead politics of Washington, but of Berlin and Paris also in this case. But the real curse of the markets is the March 09 trendline which, with the cooperation of the brain dead politicians, holds sway over the market. For all practical purposes most issues are in sideways trends. Only idiot savants, traders and cheaters make money in these markets. Some savants — idiots or not — have been touting the Russell 2000 — and it’s not totally a bad idea to have a piece of it.

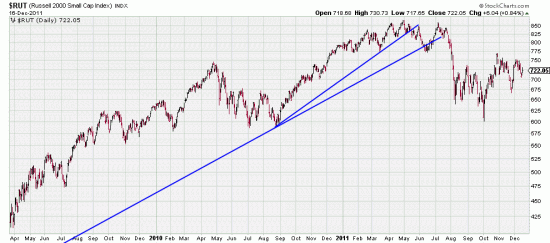

But as can be seen here the Russell is under the curse here also and is in the same sideways trend.

But as can be seen here the Russell is under the curse here also and is in the same sideways trend.

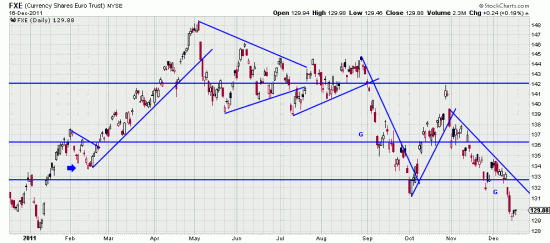

Holy vampires, Batman, where can an honest trader/investor get on a decent trade? RIMM short? Yes. Euro short? Yes. Even the gold and silver are shorts. We say this with much trepedation. There is much to be said for being hedged — our position in the indices at the moment– or for day trading the two minute bars. Or for a dividend only strategy. Or for a weekly bar strategy using Basing Points.

We have talked often of shorting the euro — you can use the EUO ETF. Right now we think a long term position building strategy is in order. Which puts the Basing Point at the December high with a 3% stop. We cover our eyes when we think of the equity volatility and the risks or any trade in the euro. So what do you do when the volatility and risks are high? Trade a smaller position unless you have paper profits on.

We have talked often of shorting the euro — you can use the EUO ETF. Right now we think a long term position building strategy is in order. Which puts the Basing Point at the December high with a 3% stop. We cover our eyes when we think of the equity volatility and the risks or any trade in the euro. So what do you do when the volatility and risks are high? Trade a smaller position unless you have paper profits on.

By our analysis the next leg of oil is down. Trendline is broken, support is broken. Worth a short with a money management stop of 5%.

By our analysis the next leg of oil is down. Trendline is broken, support is broken. Worth a short with a money management stop of 5%.

We have over a long and checkered career experienced many treacherous markets. At the moment we don’t remember a worse one. We are going on a turkey hunt (Wild Turkey) to see if we dredge up more traumatic memories. Gobble Gobble.