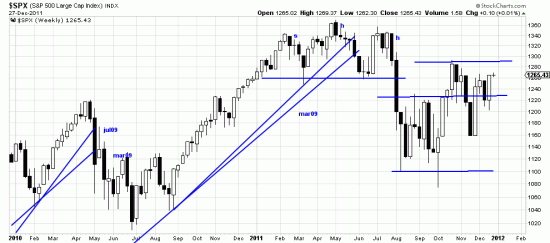

Since this moment is the product of the past, here is the past. The bear market of 08-09. The dominant fact here is the trendline from March 09. Not to mention over 700 days of bull market. But after that, in June prices broke the trendline and then all hell broke loose. There were several trendline breaks before the June break, which we noted at the time.

Since this moment is the product of the past, here is the past. The bear market of 08-09. The dominant fact here is the trendline from March 09. Not to mention over 700 days of bull market. But after that, in June prices broke the trendline and then all hell broke loose. There were several trendline breaks before the June break, which we noted at the time.

In May 2010 several trendlines were broken which provoked a correction. Before the Mar 09 trendline was broken in June a 9 month trendline was broken, prelude to the turbulence. It was clear to us, and we pointed it out at the time that a radical change of the market was in the offing. In late July the unfolding pattern became clear to us, and it fitted the magnitude of the occasion. It was a six month head and shoulders. We noted this in our letters, and dropped a note on Mark Hulbert of Marketwatch who wrote a column based on our letter.

In May 2010 several trendlines were broken which provoked a correction. Before the Mar 09 trendline was broken in June a 9 month trendline was broken, prelude to the turbulence. It was clear to us, and we pointed it out at the time that a radical change of the market was in the offing. In late July the unfolding pattern became clear to us, and it fitted the magnitude of the occasion. It was a six month head and shoulders. We noted this in our letters, and dropped a note on Mark Hulbert of Marketwatch who wrote a column based on our letter.

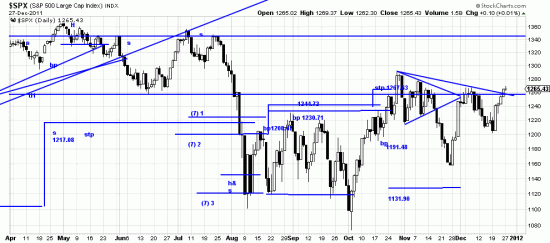

A head and shoulders pattern is never really valid until the neckline is taken out. But in August you could see prices plunging towards the neckline. And when it was taken out it fulfilled a host of measuring methods — h&s , rule of seven — though it never totally reached rule of seven goals. Instead it consolidated in a series of bungee moves — up and down. The first week in October it fell out of the range and looked like a sell signal. False. At the end of October it gave a buy signal, then promptly hammered longs. Nonetheless that is the signal which is still in effect for long term traders.

The bungees exited into a triangle — which can be a consoliation or continuation. Prices fell out on the downside, which should have set off a large downwave — but like all the other signals for the last six months it was a false move and was canceled by three or four days of rocket ship moves.

The bungees exited into a triangle — which can be a consoliation or continuation. Prices fell out on the downside, which should have set off a large downwave — but like all the other signals for the last six months it was a false move and was canceled by three or four days of rocket ship moves.

That is where we are. If readers heeded our warnings they should have been spared the pain almost all traders experience this year. The list of traders who hung up their cleats gets longer every day. John Paulson (the good Paulson, not the evil one) took hits of 40% plus. Bill Gross the bond genius took gas. We understand that Soros also did some suffering. We have constantly pointed out since August that readers should be out, hedged or trading. After these adventures readers should be thorough believers in the power of old fashioned edwards & magee analysis. The analyses have been extremely accurate — though this has not been a period to make money. It has been a period to avoid being decimated. For our personal accounts we have made a little and lost a little trading. We are now long in a trade in the SPX and hope our readers are smarter. Our analyses depend on smart readers –who know what to do with the analysis.

Merry Christmas and Happy New Year (has to be better) to our much valued readers. In the new year we will explore some new ways of profitable trading.