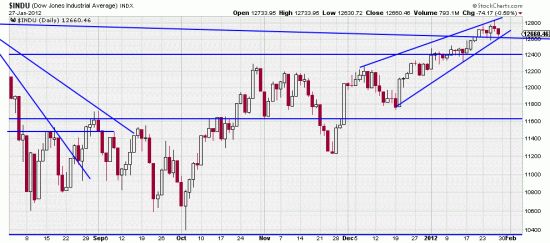

There is never any lack of disagreement amongst the punditry. This is also true for technical analysts. And for fundamental analysts. And for analysts of all other stripes (and spots). That’s why we have horse races and super bowls and the stock markets. In the chart above we see one of the objects of disagreement — or ammunition for the bear side. Converging trend lines are the sign of the wedge, which is thought to have bearish implications. Some pundits are looking at this and calling for a “correction”. 10% is what they are looking for. Readers will remember our market dictum, that all waves generate their antithesis. The upwave generates the downwave (or sidewave), and vice versa. So it is good to be alert here for the inevitable reply to this upwave which now counts 27 days. Be a Boy Scout. Be Prepared.

There is never any lack of disagreement amongst the punditry. This is also true for technical analysts. And for fundamental analysts. And for analysts of all other stripes (and spots). That’s why we have horse races and super bowls and the stock markets. In the chart above we see one of the objects of disagreement — or ammunition for the bear side. Converging trend lines are the sign of the wedge, which is thought to have bearish implications. Some pundits are looking at this and calling for a “correction”. 10% is what they are looking for. Readers will remember our market dictum, that all waves generate their antithesis. The upwave generates the downwave (or sidewave), and vice versa. So it is good to be alert here for the inevitable reply to this upwave which now counts 27 days. Be a Boy Scout. Be Prepared.

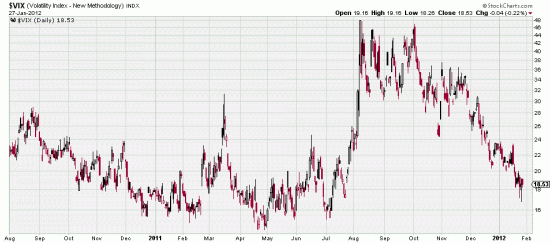

We think the preparation here is a trend stop. Over the last week or so there has been a change of mood in the markets. The dollar uptrend appears to be over. The euro downtrend appears to have reversed. The market phobia about Greece appears to have eased (don’t go to sleep. Remain wary of Greeks bearing bonds.) . (If in doubt about the punctuation here, please refer to Eats, shoots, and leaves.) Reflective of the mood the volatility index has sunk almost as deep as the Concordia (but with less loss of life.)

Note what happens when the VIX gets somnolent. It blows up in your face. Experienced and professional traders often buy straddles when the volatility gets dangerously low. In the 1987 crash we bought boatloads of straddles because our analysis showed volatilities at historic lows. This chart doesn’t seem to forecast a hurricane, but relatively speaking the relative level should inspire alertness. The Basing Point for the Indu is Dec 19 at 11735.19 which gives a stop of 11148.43 (5% filter).

Note what happens when the VIX gets somnolent. It blows up in your face. Experienced and professional traders often buy straddles when the volatility gets dangerously low. In the 1987 crash we bought boatloads of straddles because our analysis showed volatilities at historic lows. This chart doesn’t seem to forecast a hurricane, but relatively speaking the relative level should inspire alertness. The Basing Point for the Indu is Dec 19 at 11735.19 which gives a stop of 11148.43 (5% filter).

At present we don’t think there will be a downwave of sufficient strength to threaten this stop. But if Greece hits a rock and starts capsizing ….

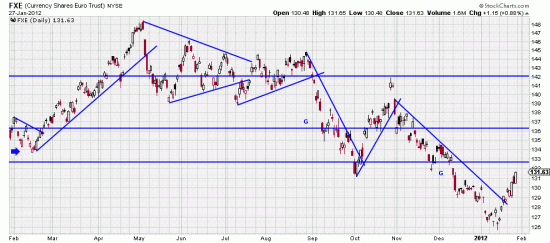

We remarked a few days ago that the euro short trade was over. Now we think the euro trend trade is over. But quite aside from that look at how neatly an old fashioned trendline analysis captures the trends in the euro. All these lines were drawn in real time. You could even go long the euro — but be aware — it is only a matter of time before Europe shatters. But the present mood and the present trend is up.

We remarked a few days ago that the euro short trade was over. Now we think the euro trend trade is over. But quite aside from that look at how neatly an old fashioned trendline analysis captures the trends in the euro. All these lines were drawn in real time. You could even go long the euro — but be aware — it is only a matter of time before Europe shatters. But the present mood and the present trend is up.