After a wave lasting 36 days one begins to examine the quality of the ice we are skating on. It doesn’t make it any easier that the TA community (not to mention the unwashed punditry) are as nervous as cats on a hot tin roof. The SPX actually has feasible trendlines — that is, we can use them as guides as to whether to exit or not, if we just use trendlines.

After a wave lasting 36 days one begins to examine the quality of the ice we are skating on. It doesn’t make it any easier that the TA community (not to mention the unwashed punditry) are as nervous as cats on a hot tin roof. The SPX actually has feasible trendlines — that is, we can use them as guides as to whether to exit or not, if we just use trendlines.

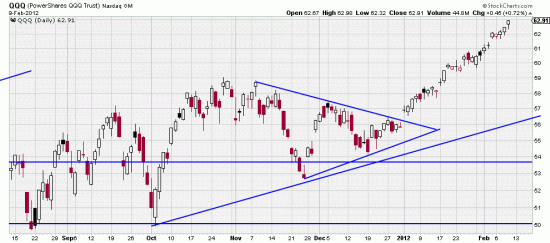

The same is true of the Qs. In the case of the INDU (not illustrated) the trendline is tighter than a bottle cap. This adds to the thin ice feeling. While analysts are baying at the moon (recently full) and looking at the market entrails they are concluding that the market is overbought. With a 36 day wave this is certainly something which concerns us. But the characteristic of markets is to get more and more overbought — if for no other reason, to teach short sellers a lesson. It is difficult, if not impossible to draw a trendline on the last 36 days. There has been no downwave — or even sidewave. Some analysts we know have sold their longs (replacing them with calls). The problem with that is, regardless of how long the wave is, it is in the clear and any resistance was long ago. Also it violates the Basing Point principle. The Basing Point is at the December low.

What to do, what to do… You could always buy puts if you have those skills or hedge with short ETFs. We’re going to buy some VXX tomorrow, not a complete hedge, just a sop to the thin ice. And certainly nothing you could analyze — more something your gut says to do. And because it’s Friday.