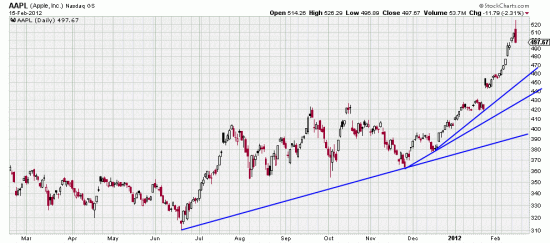

We remarked a short while back that Apple appeared to be going parabolic. It’s hard for us to imagine that there is a trader out there who hasn’t heard our rant about parabolic curves — that they ALWAYS collapse. Today Apple exhibited a classic reversal day. Opened up strong, ran up more, then turned and finished down 2.31% for the day. Also the day is a key reversal day. The results of this should be a sell off quite possibly back to 445 or, actually, who knows. Since this is nothing more than a burp in the life of Apple dip buyers will be waiting eagerly. For the record the stop we have calculated working off the Basing Point of 1/24 (419.55) is 398.57 (5% filter).

We remarked a short while back that Apple appeared to be going parabolic. It’s hard for us to imagine that there is a trader out there who hasn’t heard our rant about parabolic curves — that they ALWAYS collapse. Today Apple exhibited a classic reversal day. Opened up strong, ran up more, then turned and finished down 2.31% for the day. Also the day is a key reversal day. The results of this should be a sell off quite possibly back to 445 or, actually, who knows. Since this is nothing more than a burp in the life of Apple dip buyers will be waiting eagerly. For the record the stop we have calculated working off the Basing Point of 1/24 (419.55) is 398.57 (5% filter).

You can always try protecting yourself by selling against the box, buying puts, selling calls, buying the VXX, praying to St Francis or Bill Bellichik. We’re going to sell our Qs since Apple has an outsize influence on it.

We also suspect this could be the turning point for the market for awhile — remember we warned you about the Barron’s curse.

Turning point now?

evidently it was the precursor to the short term turning point. Stick with apple.

$1000 we don’t know, but more surely.