Someone casually dumped 100,000 futures contracts into the bond pit yesterday roiling the bond markets and roiling trader’s emotions — which are pretty roilable all the time. Selling panics then developed in the precious metals markets, though the stocks didn’t seem to be much affected. Naturally Bernanke was blamed, and why not. Someone has to be blamed. If he’s not blamed for what he says he’s blamed for what he didn’t say. So when Helicopter Ben said he wasn’t taking any cruises on the QE3 everybody got mad and sold gold. Drove a hole in our gold profits, which were considerable. Oh, well, easy come, easy go.

Someone casually dumped 100,000 futures contracts into the bond pit yesterday roiling the bond markets and roiling trader’s emotions — which are pretty roilable all the time. Selling panics then developed in the precious metals markets, though the stocks didn’t seem to be much affected. Naturally Bernanke was blamed, and why not. Someone has to be blamed. If he’s not blamed for what he says he’s blamed for what he didn’t say. So when Helicopter Ben said he wasn’t taking any cruises on the QE3 everybody got mad and sold gold. Drove a hole in our gold profits, which were considerable. Oh, well, easy come, easy go.

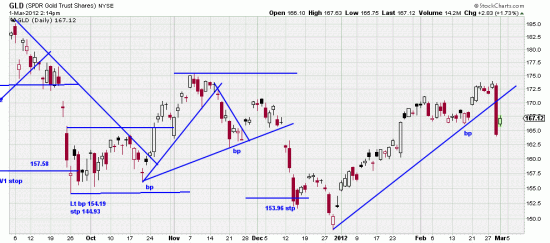

You could pack up your tents and steal away, or you could sit on the Basing Point and see whether it’s a real change of trend. The BP is marked and with a 5% filter the stop is 157.86. Since for us it is a trading situation we’re outta there. As you can see it didn’t just break the trendline, it shattered it.

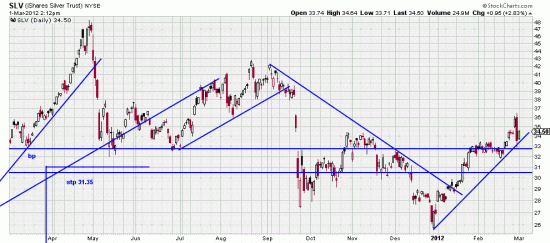

Silver is not in exactly the same situation. The trendline is not broken. The Basing Point is in the same place and the stop is 30.22.

Silver is not in exactly the same situation. The trendline is not broken. The Basing Point is in the same place and the stop is 30.22.

Now for those touchy-feely questions. We suspect that a day like yesterday marks the end of a phase, and that something new will happen here in the near future. Amazingly the plodding uptrend in the major indices continues. Maybe this is the harbinger of the end. Whatever. Good practice advises that we sit on the positions until something –ANYTHING — happens. In the meantime the equity gets fatter and fatter.

The players in the musical chairs game are so uptight they are cheating by keeping a hand on a chair against the end of the music. Previous questions as to what to do have been discussed at length in recent letters. Same, same.