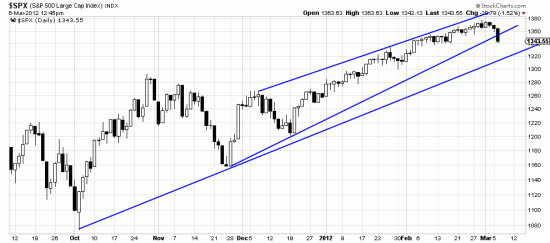

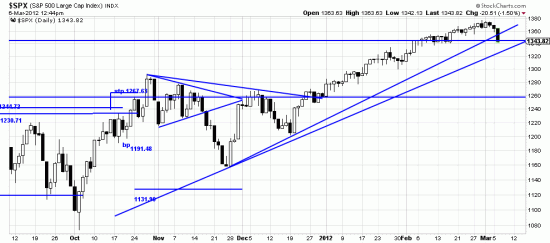

Volatility is like a spring. Keep pressing it down and compressing it and it stores up energy like an oil well waiting to gush. Today it’s gushing. We remarked a letter or so ago about the changed mood in the market. Here it is in spades. And it is a trading exit signal, for traders. So never one to wait for the bum’s rush (though this may be one) we have bailed on the Qs, the silver, the Dow. All that’s left in the trading portfolio at this point is too much UPRO and TVIX. The UPRO will be departing shortly. Note WELL. These are trades. The trend stop for investors smarter and more patient than ourselves is back there in Patagonia (the country not the clothes shop). Illustrated below.

Volatility is like a spring. Keep pressing it down and compressing it and it stores up energy like an oil well waiting to gush. Today it’s gushing. We remarked a letter or so ago about the changed mood in the market. Here it is in spades. And it is a trading exit signal, for traders. So never one to wait for the bum’s rush (though this may be one) we have bailed on the Qs, the silver, the Dow. All that’s left in the trading portfolio at this point is too much UPRO and TVIX. The UPRO will be departing shortly. Note WELL. These are trades. The trend stop for investors smarter and more patient than ourselves is back there in Patagonia (the country not the clothes shop). Illustrated below.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p14915829429&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p14915829429&a=214966864

(link for a bigger version)

The system has set us a very wide stop. We firmly suspect that the reason for this is that a major bull market is waiting on the other side of this downwave. We will indicate the reentry point, both for traders and trenders.

Meanwhile the market mind has sold everything — gold, silver, currency pairs included. So get ready for a little toboggan ride here. You could probably short the metals here, but we didn’t. Shoulda, coulda, woulda.

Is the reason for exiting the position on the QQQ and SPY because the intermediate trend has been broken by the penetration of the rising wedge or is it the breaking of a minor trend?

I’ve read the book technical analysis of stock trends and am trying to figure out if the rationale is part of what I was supposed to understand in the book.

I appreciate the response if someone has the time to explain.

This was a trading signal. a power bar across a significant trendline. The major trend appears to be intact, but experiencing consolidation. It always pays to know whether you are trading or trending. Trending always wins biggest in the long run, while enduring some drawdown pain along the way.