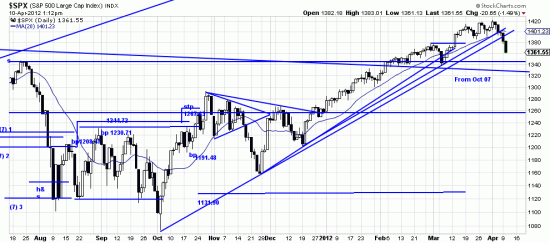

The little runaway bull got corralled. First, the breaking of the major trendline from 07 must be honored by a pullback (or a throwback, or a half back). Second, we have a break of the 20 day moving average — that alone will provoke selling among the short term trading lot. Third, we have a number of trendline breaks. Illustrated below.

The little runaway bull got corralled. First, the breaking of the major trendline from 07 must be honored by a pullback (or a throwback, or a half back). Second, we have a break of the 20 day moving average — that alone will provoke selling among the short term trading lot. Third, we have a number of trendline breaks. Illustrated below.

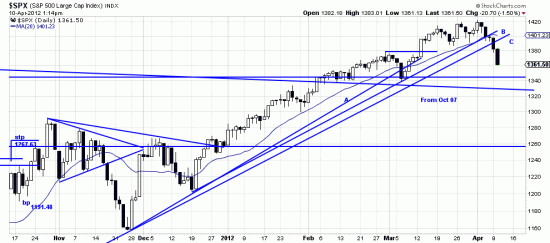

Labeled A, B and C, these are not of excessive importance, though C — the line from October must be respected. 4 months long, and broken now by a 4% downwave.

Labeled A, B and C, these are not of excessive importance, though C — the line from October must be respected. 4 months long, and broken now by a 4% downwave.

The horizontal trendline is a source of support, as is the downtrendline from 07. So — with no help from the bears — we should see this little downwave play itself out and be a welcome opportunity to add on positions.

In the meantime consider the purpose of this punishing end to the long upwave which it ends: First of all the market must punish those who ate their hearts out and distrusted the wave but finally threw their chips in. This is the eternal story of the markets — just when you think you can trust it it pulls a gotcha. Second, Before you can take the market up you have to flush the weak holders. You need them sitting unhappily on the sidelines aching to get in as the market rises — then jumping back in at the top so you have someone to distribute your shares to. So — all right and operating normally in the market universe.

Observations without charts: Gold and Silver which we remarked on as shorts some letters back remain in downtrends. Dollar and Euro remain in sidetrends. IWM has a broadening top but we will be looking at a buy when the shooting stops. At the moment we are expecting a sharp reversal of this downwave and a difficult reentry. We have on some partial hedges — but as they say, small comfort in the wise — and less comfort in the the wiseacres.