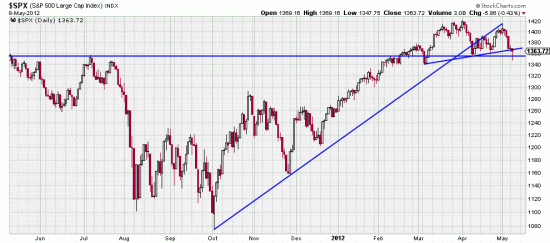

With Greek Medusa raising her ugly head, badly in need of a hair cut, the markets are turning to stone. In a few days what looked like a minor reaction to a minor trendline break has taken on an ugly cast. From a chartist’s view the markets look a little toppy — as we have thought, could be a consolidation or minor wave down.

With Greek Medusa raising her ugly head, badly in need of a hair cut, the markets are turning to stone. In a few days what looked like a minor reaction to a minor trendline break has taken on an ugly cast. From a chartist’s view the markets look a little toppy — as we have thought, could be a consolidation or minor wave down.

But it behooves us to look at some objective systems.

The PnF SPX has turned bearish, looking for a target of 1280. Measuring the bar chart we can see the possibility of 1290. Close enough for horseshoes. Readers will –or should — or damn well better — remember that when we looked at high targets with PnF charts earlier this year that we cautioned that PnF charts say nothing about time. In fact we still hold to those early analyses. We are busy purifying the market so that it will be safe for hedge funds and major traders to take the market up. In the meantime this little squall will remind traders that sailing is always challenging around San Francisco Bay (note two recent tragedies).

The PnF SPX has turned bearish, looking for a target of 1280. Measuring the bar chart we can see the possibility of 1290. Close enough for horseshoes. Readers will –or should — or damn well better — remember that when we looked at high targets with PnF charts earlier this year that we cautioned that PnF charts say nothing about time. In fact we still hold to those early analyses. We are busy purifying the market so that it will be safe for hedge funds and major traders to take the market up. In the meantime this little squall will remind traders that sailing is always challenging around San Francisco Bay (note two recent tragedies).

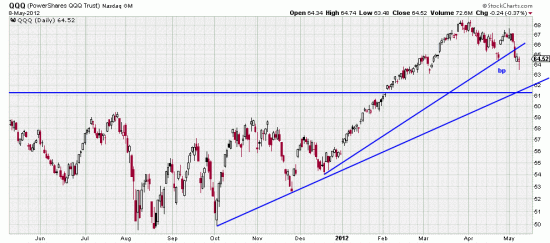

This downwave is taking down the indices, but at least the Qs still have a positive chart. The short term trendline is broken, but the long term trendline is, as we have said, down in the Caymans with Mitt’s money. (Could be in Switzerland visiting our cousins, who are still there making cuckoo clocks.) Note the Basing Point: 64.45, stop 61.22. We will be doubling down here soon.

This downwave is taking down the indices, but at least the Qs still have a positive chart. The short term trendline is broken, but the long term trendline is, as we have said, down in the Caymans with Mitt’s money. (Could be in Switzerland visiting our cousins, who are still there making cuckoo clocks.) Note the Basing Point: 64.45, stop 61.22. We will be doubling down here soon.

We have not illustrated it here, but the candlestick patterns of the last few days are what they call hammers — that is hard sell offs, followed by recoveries on the day, meaning that there are buyers down there for those oversold prices. Whether the buyers are our lot, or the contrarians who are driving this volatility (who should be heavily taxed for their contributions) not known.

Note that the euro has fallen out of its trading range and is a sell. Note also that your shorted the gold and silver back when we pointed it out (we didn’t take the trade ourselves –why not? –or, shouda, coulda, woulda) this downwave is less annoying.

More on that later.