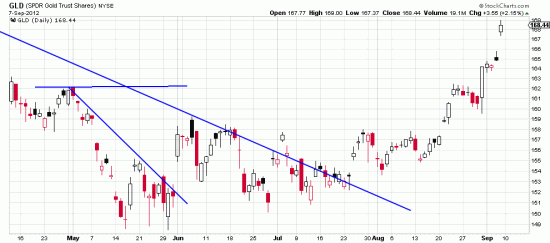

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=5&dy=0&id=p96388783504&a=255869372

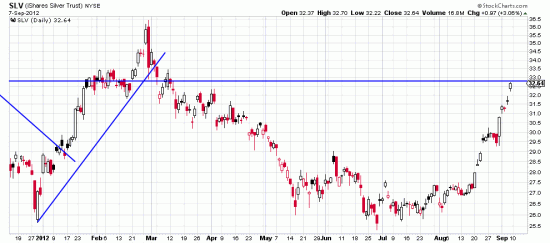

http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=9&dy=0&id=p15218233755&a=236108789

http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=9&dy=0&id=p15218233755&a=236108789

You can’t get much clearer flags than those flying in gold and silver today. Virtually perfect formations. So what do you do when you have a lead pipe cinch? Bet the ranch?

Maybe the outhouse, but not the ranch. And besides that, which way, long or short?

Ironically a flag is more likely a temporary top than a continuation. Here are ways to play it: You can take profits and short it immediately. The stop would be 1/2% above the high. While it is unlikely that further explosive upside will result a smarter way might be to place a tight stop under the last day, say 1/2% under the low. Each day, if the price rises, place a similar stop. Conservative traders would wait for the gap to be closed before shorting.

As for us we’ll reverse on Monday, taking some fairly decent profits.