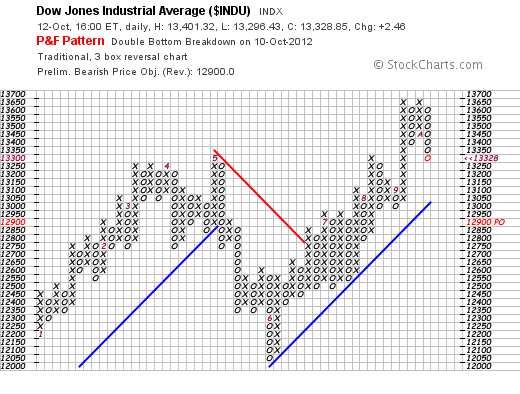

Friday the PnF charts displayed new (bearish) patterns. We don’t make our decisions based on PnF charts but we watch them out of the corner of our eye. The method looks for a target of 12900 in the Dow.

Friday the PnF charts displayed new (bearish) patterns. We don’t make our decisions based on PnF charts but we watch them out of the corner of our eye. The method looks for a target of 12900 in the Dow.

The target in the SPX is 1380. PnF charting is a fallible as every other analytical method but it doesn’t pay to scoff too vigorously. As we have pointed out we are in a downwave at present with some broken trendlines, so these charts are added weight to our presently bearish expectations. We would be moderately surprised if these targets were met — and readers should remember our PnF analysis some months back which looked for a target of 1565 in the SPX.

The target in the SPX is 1380. PnF charting is a fallible as every other analytical method but it doesn’t pay to scoff too vigorously. As we have pointed out we are in a downwave at present with some broken trendlines, so these charts are added weight to our presently bearish expectations. We would be moderately surprised if these targets were met — and readers should remember our PnF analysis some months back which looked for a target of 1565 in the SPX.

As a trading decision — not an investment one– we are hedged in the indices, and long the gold and silver. These two are busy gaining steam for some sort of mischief (hopefully long side). The PnF chart in the gold looks for 220 in GLD.