You could take all of Congress (and throw in most money managers) grind them into a powder and throw them in a cocked hat and not equal the weight of Dave Brubeck, who just died. We were misspending our college years when Brubeck opened the firmament of jazz to us and we have never deviated from being fanatic fans. Especially as an antidote to rock-n-roll, if you haven’t played Take Five in a few years (or ever) get it and experience perfect rhythm. (Get a little Anita O’Day and MJQ too.)

We have previously noted that in the giving season we habitually donate to the Food Bank at Thanksgiving and Christmas. Our local foodbank is sffoodbank.org. You can find yours at google. If you make a donation (of any size) and email us noting that fact we will (when it is ready — be prepared for a long wait) send you a copy of the ebook we are presently inch worming along on — The Secrect of the Markets — which does indeed contain the secret of the markets, as well as other short pieces on systems and trading.

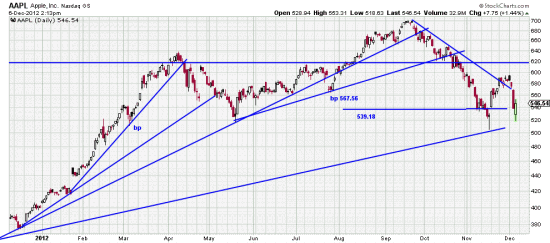

http://stockcharts.com/h-sc/ui?s=AAPL&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=256938322

What a marvel is Apple. And what a magnet for unending bull crap from the media — which often influences investors who don’t have enough sense to ignore the ink stained wretches.

Some important trendlines are broken here, and prices have even closed below the Basing Point stop. In the old days disciplined investors would have stopped themselves out. In the present atmosphere of false signals and undependable methods the situation at the moment must be evaluated and a qualitative decision must be made: Is there a trend reversal, or is the stop point acting as a support instead?

The real decision here is not so much about the technical situation as a personal decision: Is the investor a true long term investor, or a swing investor?

If he is looking to shorter term concerns then he attempts to ameliorate the effects of a slide like Apple’s here. If he is a Dow Theory length investor he observes the stop from the weekly system:

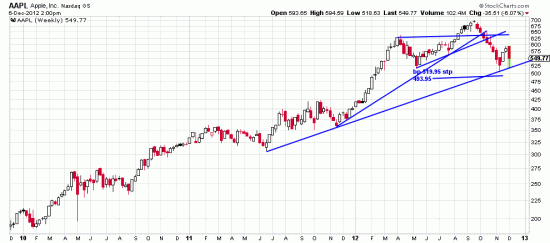

http://stockcharts.com/h-sc/ui?s=AAPL&p=W&yr=3&mn=0&dy=0&id=p21121133369&a=279931009

http://stockcharts.com/h-sc/ui?s=AAPL&p=W&yr=3&mn=0&dy=0&id=p21121133369&a=279931009

Here the weekly long term situation is illustrated, and the stop is lower, and note that the long long term trendline may be acting as support to prices.

Again, the question is not the particular variant of the system, but the particular variant of the investor.