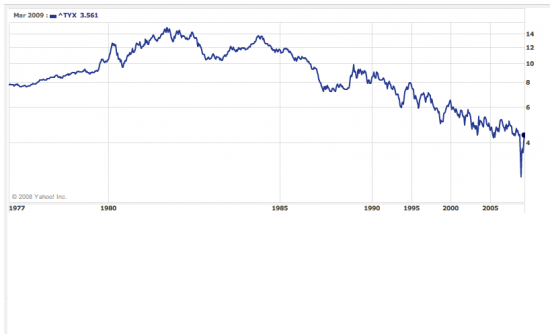

In bondage to bomds. Above thirty years (m/l) of interest rates. The inscrutable march of history dictates that the end is near — but doesn’t give any dependable date. What do you do about that? Well you start not sleeping too soundly if your portfolio is heavy into bonds, and you probably start lightening up in that asset. For our part we shorted the TLT a few weeks ago and the trade is making money.

In bondage to bomds. Above thirty years (m/l) of interest rates. The inscrutable march of history dictates that the end is near — but doesn’t give any dependable date. What do you do about that? Well you start not sleeping too soundly if your portfolio is heavy into bonds, and you probably start lightening up in that asset. For our part we shorted the TLT a few weeks ago and the trade is making money.

But nothing like the money it’s going to make. An avalanche starts with a very small snowball rolling down the mountain. Every trader in the world knows that when the Fed raises rates it will raise hell. Fire breathing, smoke producing hell. And will change the market game irreversably. This change of paradigm will be an enormous opportunity — on the short side. And we expect to take advantage of it.

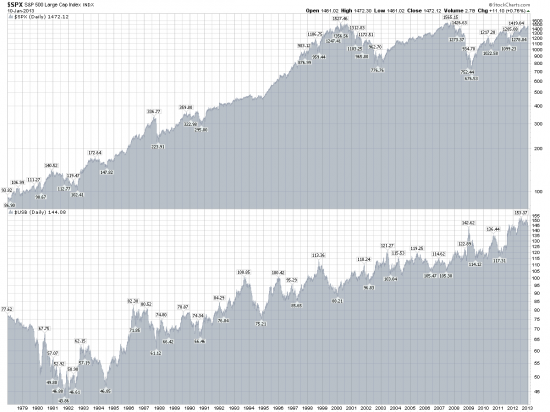

Below an interesting chart showing the SPX compared to bond prices.

SPX above, bonds below. Apologies for no link to this at this time. It is not from our usual source, stockcharts.com.