http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p34555890157&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p34555890157&a=214966864

http://stockcharts.com/h-sc/ui?s=$INDU&p=W&yr=4&mn=0&dy=0&id=p95004260755&a=268628424

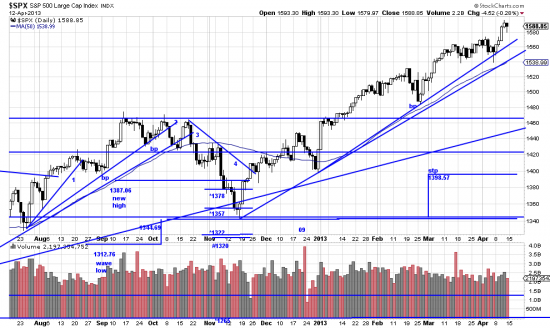

In this comparison of peers the better picture of the market is the indu, and we think it better reflects the true state of the market. The very tight trendline in the SPX is of negligible analytical value here (but our feelings would be hurt if it got broken). As though freaked by the line the SPX took off and the advance foretold by the consolidation seems to have started.

Readers can see where we think it is headed. Once again: ignore predictions.

We were short silver and got impatient with the trade–closed it and paid the price. Now we have had to put it back on at a worse price. And we paid a higher price to put the gold short on too. But the volume and violence of the move in the metals demanded at least small opening trades.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=5&mn=0&dy=0&id=p31723949560&a=290122392

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=5&mn=0&dy=0&id=p31723949560&a=290122392

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=5&dy=0&id=p95239461628&a=255869372

http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=9&dy=0&id=p15218233755&a=236108789

http://stockcharts.com/h-sc/ui?s=SLV&p=D&yr=0&mn=9&dy=0&id=p15218233755&a=236108789

Silver and gold are behaving the same. We take it that the hedge funds are dumping their holdings. These have been tricky markets for us, after having reaped profits of 189 and 201 percent on long term trades we thought we were smarter than they were. Every time we think that the market kicks us in the shins. Can’t we enjoy a little hubris for just a short time? Can’t we?

No.