http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p88150915824&a=214966864

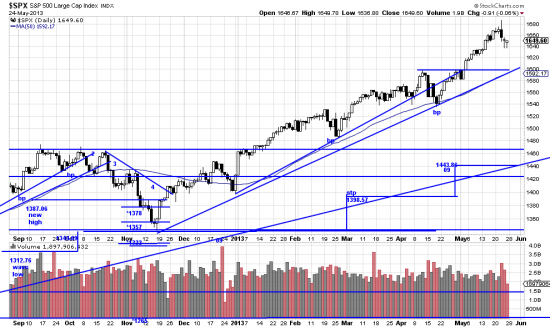

It might seem strange to regard the week as not much — especially when the SPX transversed 38 points on Wednesday and the Nikkei took a 6% dive. How can this be? Easy. Same as any sea going voyage (in the Bermuda triangle) good weather for weeks then one little old Mass Coronal Explosion and a couple of sun spots and cometh the squalls. If they don’t sink you you’re basically all right, and it looks like we’re all right. Check in a few days to see if we sprung (spranged?) any leaks.

We joke — as in he who ne’er felt a wound–but we take days like Wednesday seriously. We hedged during the day — but were out of it next day. Such days often are warnings of worse weather to come. And we will in all probability see some erosion here, but that is a good thing. Contrarians were begining to breathe hard and slaver. But trend followers have a way of dealing with squalls — they discount them as market efforts to dislodge weak hands.

Japanese stocks on the other hand were in a parabolic rise (we pointed out back in March that Japanese stocks were breaking out), and what goes parabolic must return to earth. Interestingly, the trendline is intact in EWJ:

http://stockcharts.com/h-sc/ui?s=EWJ&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=227075581

http://stockcharts.com/h-sc/ui?s=EWJ&p=D&yr=1&mn=0&dy=0&id=p20970412253&a=227075581

This is pretty surprising and might make EWJ a buy. We think Japan is on the right economic path. But if we buy it we will have a tight stop. 2% under that line and it’s sayonara, lotus blossom. Sayonara is Japanese for adios. Speculative.