http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=8&dy=0&id=p57309614995&a=266398464

The chart doesn’t care why the market got a shot of pure oxygen. All it cares is that as everybody is saying, that prices are in open air. That is the reason you buy new highs. And you can buy new highs here. Ben gave us a power bar that ought to shut up the bears. This is, of course, not the first time prices have been in open air. Last month a new high was made to be promptly jumped on by contrarians. There is a rule to deal with these things — the three percent penetration rule. But forceful tacticians buy the breakout with a plan to deal with an immediate reaction — usually a tighter stop than the trend stop– perhaps 3% from the breakout low.

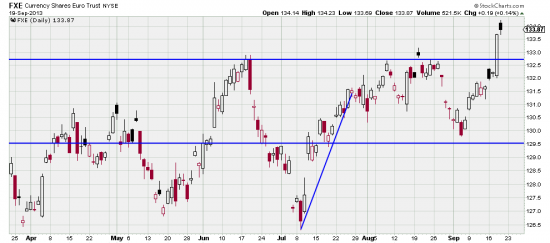

The day impelled signals in many issues. (Closing our gold short.) You could take the bar as a buy signal as you could in the euro.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=9&dy=0&id=p79177025382&a=255869372

We are still deeply skeptical about gold, but the chart says buy it. Whether a short term trade or investment to be determined. Stop 3% under the low of the day.

http://stockcharts.com/h-sc/ui?s=FXE&p=D&yr=0&mn=6&dy=0&id=p24430755344&a=216019099

The euro reacted to Chairman Ben also throwing off a strong buy signal. The conservative Basing Point stop is 5% under the September low, but you can stop it tighter with a 3% stop under the low of the day.

Enjoy the gift.