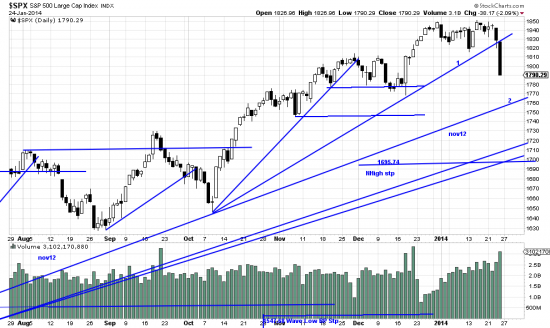

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=6&dy=0&id=p83257770514&a=266398464

You’re flying along at 30,000 feet and the next thing you know you’re flying along at 28,000 feet and you have coffee in your lap and the captain says, just a mild bump folks, keep your seat belts fastened. May be some more turbulence ahead.

First of all let us dispel the crackling interference of the pundits and talking heads who are desperately trying to explain the reasons for that Thursday-Friday break. It doesn’t have to do with China or the taper or the fact that parvenus like the Seahawks won the NFL west. It has to do with musical chairs. Big guys got antsy and dumped stock. Economists call it supply and demand.

What do we make of this in retrospect? Viewed in the larger perspective of the long wave it’s just a mild bump — though annoying to have coffee spilled in your lap. First some facts: Prices basis SPX are already down about 3%. The oct13 trendline (1) is broken (not to be discounted–more downside likely.) A 10% break would take out our new high stop. We see that as unlikely. And prices are only about 2% above the nov12 (2) trendline. We can see this broken without hell to pay if the break is contained. In other words the break would have to be more than a mild bump.

Looking at the market over the long term there is no sign that the market has topped. There is no head and shoulders or double top or steeple top or spinning top or dreidel — and, for what it’s worth the PnF chart is looking for a target of 2020 — (with a high pole warning we will explain in our next letter). We agree with the 2020 target (remember we don’t predict and we don’t stand behind these speculations). For all the money which fled the market there is a torrent champing at the bit on the sideline (including some of ours). We will be looking for the next entry point, so stay tuned.

Our choices are as specified in our last letter (none attractive). Of course we always resist and try to hedge and dodge and weave and always lose money on our hedges. In some family accounts where we don’t hedge profits continue to accumulate and these accounts beat the active ones time after time. Someday we’ll learn that lesson. It’s not buy and hold. It’s buy and hold until the trend changes. The big guys who just dumped their stock will lose money reestablishing their positions.

We expect the coming week to be interesting and we will be publishing frequently depending on how interesting.

Remember that old Chinese curse: May you live in interesting times.