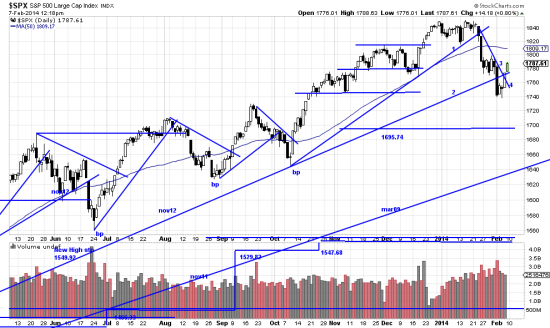

99% of what we do is based on the solid granite method and principles of John Magee. 1% is experienced instinct and cocked antennae. That said we thought there was a change of phase — or rhythm or game at the end of last week. After some Sochi style falls it looked to us like the sell off was over. This is partly a feeling and partly some technical facts. The facts are the pattern in the majors — which could easily be the alpha-beta-gamma-zeta pattern.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=9&dy=0&id=p83750808625&a=214966864

As always you never know till later, so we wait for follow through to confirm our suppositions and analyses. Other facts include gold and the bonds. Gold is nose up against two sources of resistance, and the wave in the bonds appears to have broken.

http://stockcharts.com/h-sc/ui?s=GLD&p=D&yr=0&mn=9&dy=0&id=p79177025382&a=255869372

Gold is encountering the horizontal and sloped trendlines here. We almost shorted it Friday as we almost shorted the bonds — and may do so Monday. Next week should tell us if the theme has changed.

You occasionally make reference to PnF charts as supporting evidence. While I have yet to decipher them, I note that the PnF for $SPX as of Feb 7 reveals a “low pole reversal” and a new bearish price objective of 1620. How strongly does this influence your view?

PnF charts I use only as confirmations of my chart analysis and as a method to look for price targets. Withal a powerful method I have only recently started using.

cb